Hi, what are you looking for?

Stock

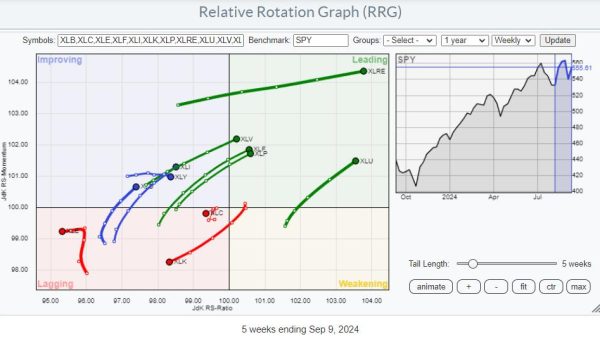

Tech Rallies But Remains Inside the Lagging QuadrantA quick look at the Relative Rotation Graph for US sectors reveals that the Technology sector is...

Stock

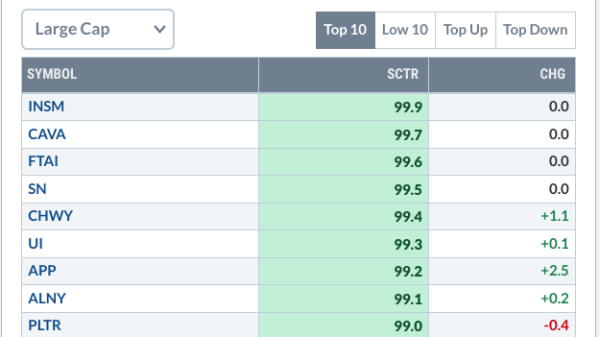

Numerous companies are making strides within their respective sectors, but, unless you follow the sector closely, you might not be aware of them. That’s...

Stock

It was a massive turnaround day in the market on Wednesday—stocks sold off after the Consumer Price Index (CPI) data was released, but, after...

Stock

In this exclusive StockCharts TV video, Joe discusses why he is a bottom-up technical analyst. He explains the difference between top-down and bottom-up analysis...

Stock

In this video from StockCharts TV, Julius takes a look at rotations in an asset allocation RRG. He compares fixed-income-related asset classes, commodities, the...

Stock

Perhaps no other industry in the world is more synonymous with risk and emergent (R&D) developments like biotechnology. While the information technology sector has...

Stock

The Real Estate sector took the lead in Tuesday’s trading, probably because interest rate cuts are approaching. Technology and Consumer Discretionary took second and...

Stock

The recent decline last week revealed that the artificial intelligence bubble is deflating. Magnificent Seven stocks are unwinding in response to investors losing confidence...

Stock

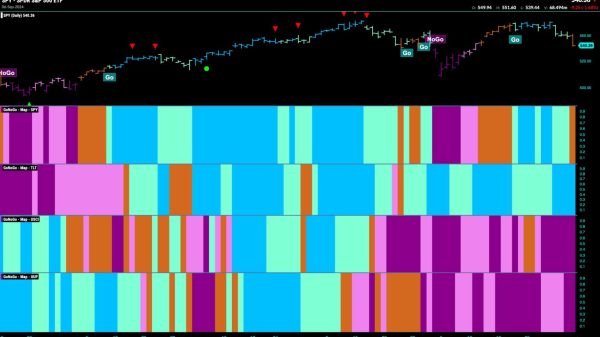

Good morning and welcome to this week’s Flight Path. Equities flashed an uncertain “Go Fish” bar at the end of the week as the...

Stock

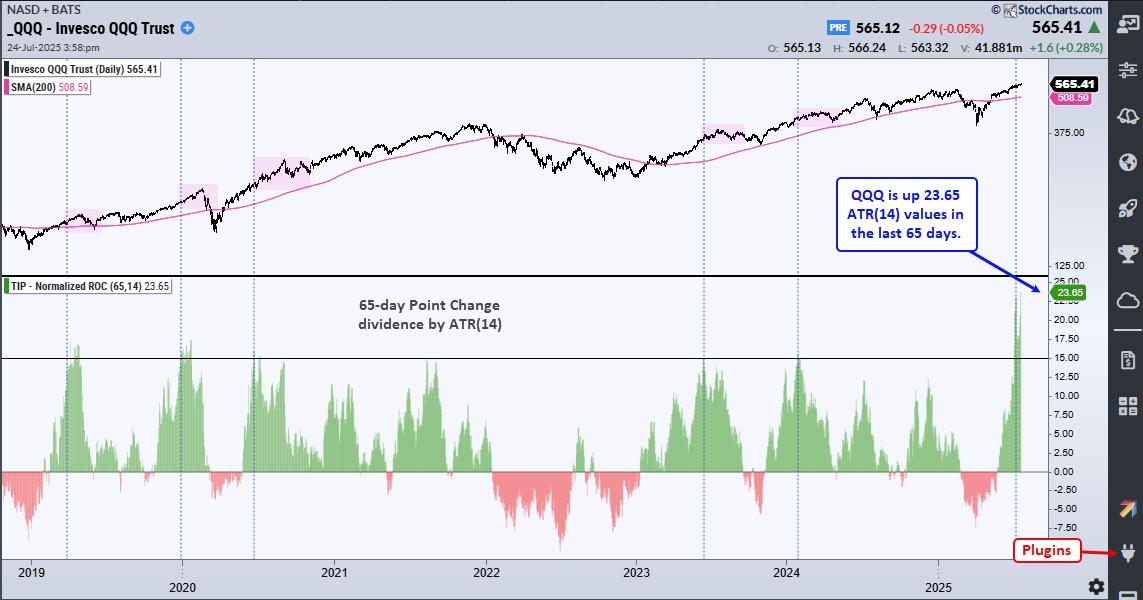

Any strategy that trades stocks needs some sort of market timing mechanism to identify bull and bear markets. Typically, stock strategies are fully invested...