Gold’s Path: $2,250/oz in Sight Amid Rate Uncertainty

Quick Look

Gold prices dip slightly in Asian trade but hover above crucial support levels. Copper sees a minor retreat but remains close to 11-month peaks after a notable rally. Bullion’s slight recovery amidst Fed meeting anticipation, with a mixed outlook influenced by global economic policies.In the labyrinth of global financial markets, gold, the age-old symbol of wealth and security, experienced a subtle decline in Asian trading sessions on Tuesday. Despite this slight decrease, gold prices have steadfastly remained above pivotal support levels. This trend underscores the market’s tentative stance toward precious metals, with investors holding their breath in the lead-up to a paramount Federal Reserve meeting slated for later this week.

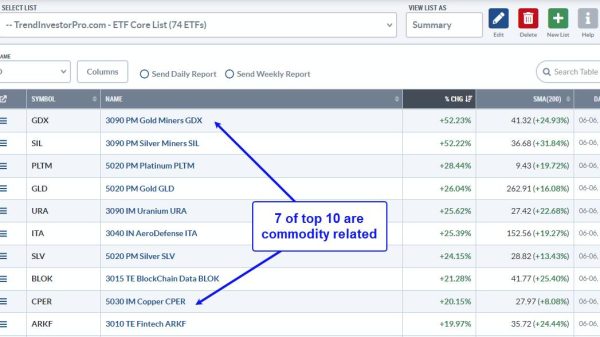

Copper Prices: A Slight Dip Amidst Stellar Rally

The narrative around industrial metals, particularly copper, mirrors this cautious optimism. After revelling in an impressive rally that catapulted prices to near 11-month highs, copper prices edged lower in recent trading sessions. Yet, they continue to flirt with these peak levels, indicating sustained interest and optimism in industrial commodities amidst broader market uncertainties.

Bullion’s Bounce Back and the Fed’s Forthcoming Decisions

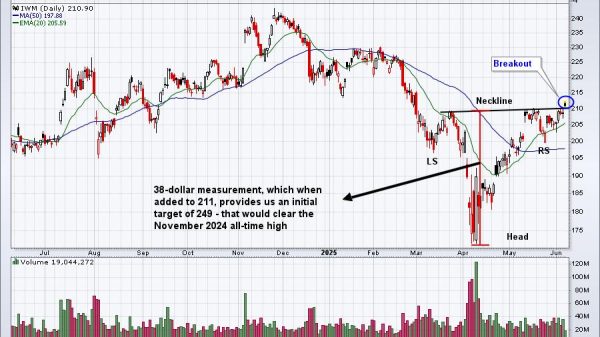

As markets fluctuate in anticipation of the Federal Reserve’s impending interest rate decisions, gold bullion prices have seen some recovery. On Monday, prices managed to rebound, surpassing the $2,150 an ounce mark. This uptick was driven by ongoing uncertainties regarding the Fed’s monetary policy direction. Nevertheless, despite this rebound, gold prices still remain well below the record highs set earlier in March.

There was a minor retreat in spot gold, experiencing a 0.1% decrease to $2,158.26 an ounce. April gold futures witnessed a similar decline, falling to $2,161.35. These changes underscore the complex relationship between the strength of the dollar and gold prices. Moreover, the anticipation of the Fed meeting, along with dovish signals from the Bank of Japan, has favoured the dollar. Consequently, this has exerted additional downward pressure on gold prices.

Market Dynamics and Future Outlook

The dollar’s rise, uncertainties about the Federal Reserve’s rate decision, and data indicating prolonged high inflation rates create a complex scenario for gold. Consequently, market sentiment leans towards a 55% probability of a Fed rate cut by June. Additionally, the increasing demand for gold through ETFs and significant purchases by central banks suggests a potential rise in price to $2,250/oz by year-end.

However, the short-term outlook for gold appears bearish. The dollar’s strength, along with the market’s anxious anticipation of the Federal Reserve’s forthcoming decision, contributes to this perspective. Furthermore, the Bank of Japan’s shift away from negative interest rates intensifies the challenge for gold prices.

The post Gold’s Path: $2,250/oz in Sight Amid Rate Uncertainty appeared first on FinanceBrokerage.