NFT Icons Drop 13% as Ether Peaks

Quick Look

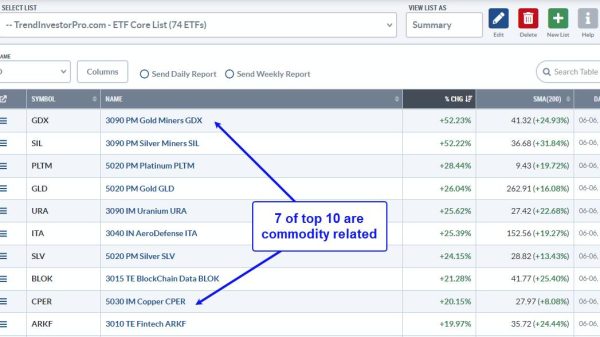

NFT floor prices significantly fall as Ether (ETH) surges past $4,000. A joint USPTO and Copyright Office study finds prevalent NFT marketplace piracy without advocating IP law changes. Phantom Labs announces a major sale in its Crypto Gambinos NFT collection alongside the launch of $MOBCOIN.In an unexpected twist, NFT markets have seen a downturn even as Ethereum (ETH), the backbone of many NFT transactions, soared to heights not seen since 2021. On March 12, NFT floor prices tumbled; iconic collections such as Bored Ape and Mutant Ape Yacht Club fell by 13%, with Azuki and DeGods seeing nearly a 9% drop. This contrast paints a complex picture of the digital asset landscape, where Ether’s intrinsic value and the NFTs’ perceived value diverge. The phenomenon underscores the volatile and unpredictable nature of the crypto world, where asset prices can move in opposite directions, defying conventional market logic.

Innovations and Collaborations Shake Up the Metaverse

Despite the market’s unpredictability, the week was ripe with innovation and collaboration. Chooky Records and TCG World’s partnership marks a significant milestone in blending music with digital reality.

Simultaneously, Phantom Labs’ Crypto Gambinos NFT collection sale and the launch of $MOBCOIN highlight the ongoing innovation within the NFT space. By halving the minting price in response to ETH’s gas fee fluctuations, Phantom Labs makes its collection more accessible, potentially democratizing the entry into the crypto community. The introduction of $MOBCOIN as a governance tool within the Crypto Gambinos ecosystem further exemplifies the blend of art, technology, and community engagement that NFTs facilitate.

Intellectual Property Concerns and Market Adjustments

The joint study by the USPTO and Copyright Office sheds light on the dark side of the crypto marketplace: piracy and intellectual property infringement. However, it also highlights the robustness of existing copyright laws in addressing these challenges without necessitating legislative changes. This acknowledgement of NFT-related infringements and the existing tools to combat them underscores the evolving understanding of digital assets’ legal implications.

As the NFT market adjusts to the ever-changing landscape of digital assets, the week’s developments encapsulate the dynamic interplay of technology, creativity, and regulation. The dip in NFT prices amidst a surging ETH, groundbreaking collaborations in the metaverse, and the ongoing dialogue around copyright issues paint a comprehensive picture of the current state of digital innovation and its challenges. These developments demonstrate the market’s resilience and adaptability and hint at the transformative potential of blockchain technology in redefining entertainment, art, and ownership in the digital age.

The post NFT Icons Drop 13% as Ether Peaks appeared first on FinanceBrokerage.