ApeCoin and Akita Inu: ApeCoin is getting closer to $2,700

The price of ApeCoin climbed to a new yearly high of 2,693 today. Akita Inu’s price was in retreat yesterday to the 0.000003242 level.ApeCoin chart analysis

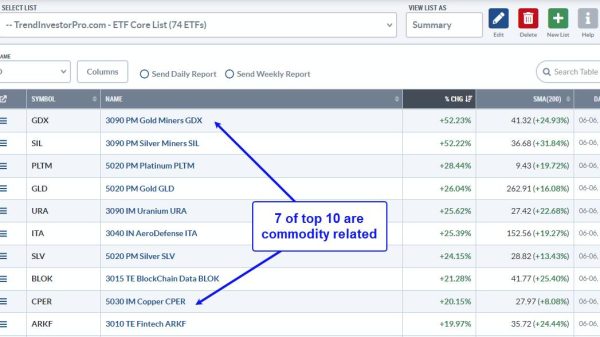

The price of ApeCoin climbed to a new yearly high of 2,693 today. Yesterday, we mostly consolidated above the EMA200 moving average and 2,200 levels. After that, a bullish consolidation was initiated last night, and we saw a break above the 2,350 level of this week’s resistance. The price did not stop there but continued to rise to today’s high. We stopped at that level and pulled back to 2,555.

The current bearish pressure could push the price even lower until it finds better support. Potential lower targets are the 2,500 and 2,450 levels. For a bullish option, we need a return above the 2,600 level. This confirms for us that we are returning to the bullish side and that we will see continued recovery. Potential higher targets are the 2,650 and 2,700 levels.

Akita Inu chart analysis

Akita Inu’s price was in retreat yesterday to the 0.000003242 level. After the new support, a bullish consolidation has been initiated and we are back above the 0.0000003400 level. Here above, we have the support of the EMA200 moving average, and we hope that with it, we can easily advance to the bullish side. This pushed us to a new daily high at the 0.0000003550 level.

This is where we test the weekly open price and must cross it if we want to see a recovery. Potential higher targets are the 0.0000003600 and 0.0000003650 levels. This week’s high price, Akita Inu, was at 0.0000003800. We need a pullback below the EMA200 and the 0.0000003350 levels for a bearish option. After that, we return to this morning’s support zone, where we will again be close to testing the weekly low.

The post ApeCoin and Akita Inu: ApeCoin is getting closer to $2,700 appeared first on FinanceBrokerage.