Last week, Growth stocks came under selling pressure, with the Nasdaq falling over 3% amid sharp declines in most of the Magnificent Seven names. These weren’t the only 2023 darlings that pulled back, as Semiconductor and Software stocks also underperformed. In turn, the Technology sector was the worst-performing for the week, with a 4.2% drop.

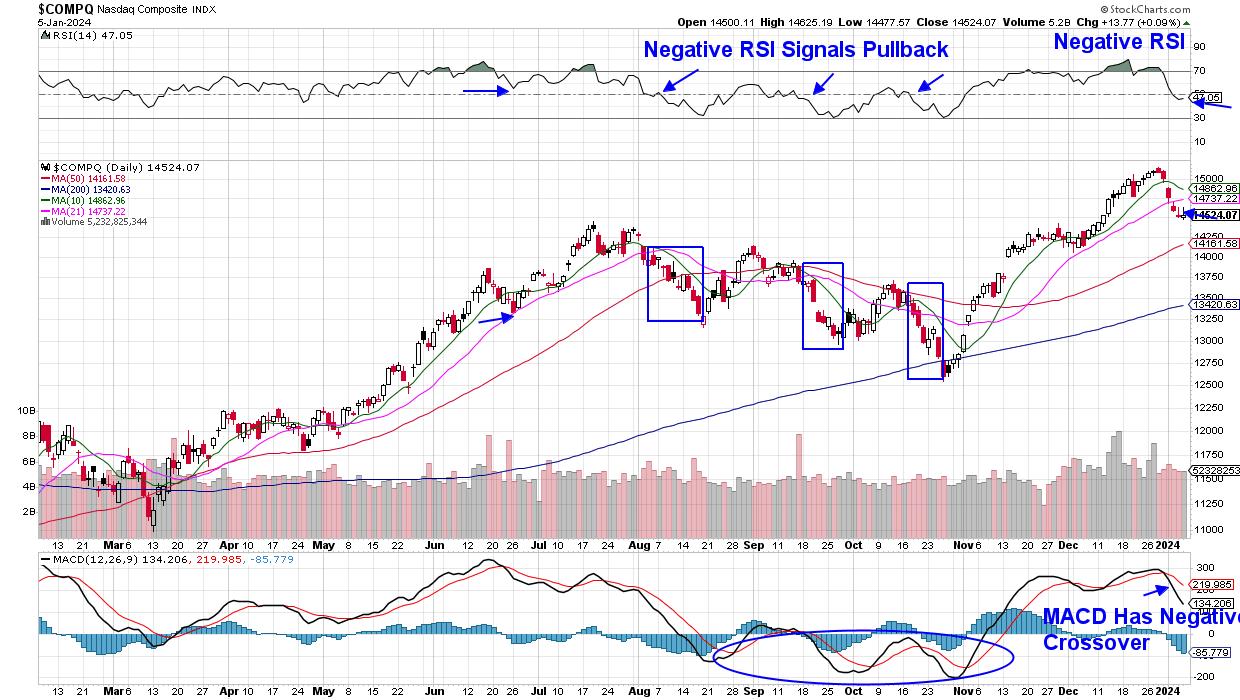

As you can see in the chart below, the Nasdaq posted a negative RSI on its daily chart last week, which is an event that also occurred 3 times last year, as highlighted. When coupled with a close below its 21-day moving average as marked by the rectangular boxes, further selling took place.

Daily Chart of Nasdaq Composite ($COMPQ)

While it’s unclear how much lower the Nasdaq may go, keeping your eye on interest rates will certainly be key. Similar to those periods of weakness last year, rates are ticking higher, with the yield on the 10-year Treasury now back above 4%. Growth stocks fare poorly in a rising rate environment. You’ll also want to examine the characteristics that marked the early November bottom in the Nasdaq, as this Index went on to regain its uptrend into year-end.

Also notable last week was a pronounced move into Value stocks led by Financials and Healthcare, which both outperformed. Next week, we’ll see clues into the fundamental state of Financials, with notable Bank stocks such as JP Morgan (JPM), Bank of America (BAC) and Wells Fargo (WFC) due to report their 4th quarter results. Management’s guidance regarding growth prospects for this year will be equally important. Each of these companies has a bullish chart heading into their results.

While pullbacks can be painful, during a bull market phase such as now, they allow strong areas of the market to set up for another leg up. Subscribers to my MEM Edge Report were advised to stay with most of the Growth stocks on the report’s suggested holdings list when we issued our Midweek Report on Wednesday. My weekly report on Sunday will provide further insights into the broader markets, as well as industry groups and select stocks. You can use this link here to gain immediate access as well as a 4-week trial, all at a very nominal fee.

Happy New Year!

Mary Ellen McGonagle