Single Stock Futures in a Changing Market Landscape

The first day of December marks a moment of reflection for investors. Dow futures start the month on a flat note following the Dow Jones Industrial Average’s impressive run in November, reaching new 2023 highs. Amidst this backdrop, the world of finance is abuzz with discussions surrounding single-stock futures. This financial instrument is gaining prominence. We delve into the nuances of single-stock futures and explore how they fit into the broader context of the market’s trajectory.

The November Surge and Its Aftermath

As the curtain falls on a robust November rally, the Dow Jones Industrial Average surged 520 points, concluding the month at 35,950.89 – its highest point in 2023. The S&P 500 and Nasdaq Composite also experienced noteworthy gains, rising 0.4% and slipping 0.2%, respectively. However, the muted start to December raises questions about what lies ahead.

Traders are carefully monitoring the words of Federal Reserve Chair Jerome Powell, expecting insights into the future trajectory of interest rates. The November rally was fueled by optimism that the Fed might halt rate hikes and initiate cuts in the first half of the coming year. The upcoming Federal Reserve meeting on December 13 adds more anticipation.

Changing Futures: Index Futures and Market Sentiments

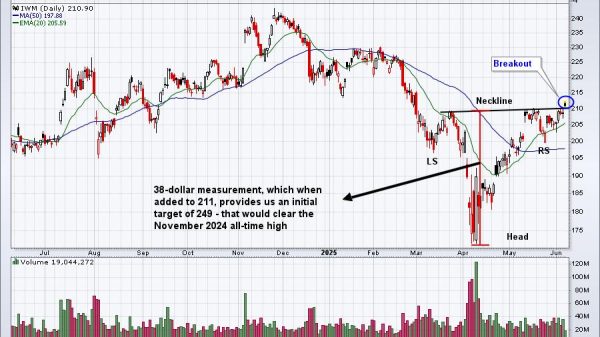

Amidst these market dynamics, the landscape of financial instruments is evolving, with a particular spotlight on changing futures. Index futures, a subset of these changing futures, are pivotal in shaping market sentiments. S&P 500 futures and Nasdaq-100 futures experienced declines of 0.2% and nearly 0.4%, respectively, reflecting the ebb and flow of market expectations.

Despite the optimism embedded in November’s rally, caution echoes through the walls of Wall Street. Some analysts, like Chris Harvey from Wells Fargo, warn of a potential correction or pullback, emphasising that the market appears “dramatically overbought.” As we navigate the remaining weeks of 2023 and anticipate the dawn of 2024, the intersection of changing futures and market caution becomes a crucial aspect for investors to consider.

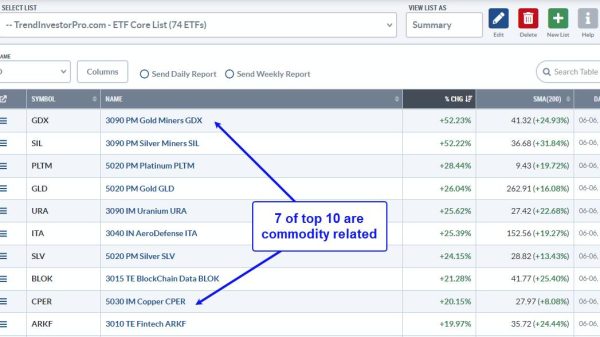

Hot Futures: Exploring the Dynamics of Managed Futures

In the realm of futures trading, the term “hot futures” has started to gain traction. These financial instruments captivate traders’ attention due to their potential for significant returns. One such subset is managed futures, a strategy that involves allocating assets across a diverse set of futures contracts, aiming to maximise returns while managing risk.

As we scrutinise the market’s pulse, we must recognise the diverse opportunities managed futures present. Investors keen on balancing risk and return may find solace in understanding and incorporating these dynamic instruments into their portfolios, especially in times when market exuberance is met with cautionary whispers.

Federal Reserve Chairman Jerome Powell is poised to address the nation in a highly anticipated speech at Spelman College in Atlanta. Investors and market analysts eagerly await insights into the future trajectory of monetary policy.

The event will unfold with Powell delivering remarks, creating a focal point for observers keen on understanding the Federal Reserve’s stance on key economic matters. A subsequent fireside chat featuring a moderator promises to delve deeper into the nuances of Powell’s remarks. Later in the day, a roundtable discussion at 2 p.m. will shift the focus to exploring tech innovation and entrepreneurship engaging with local leaders. Amid a backdrop of recent economic reports indicating a deceleration in inflation, market sentiments lean toward the belief that the Federal Reserve has concluded its series of interest rate hikes. In fact, there is growing speculation that the central bank might initiate rate cuts in the upcoming year.

Navigating the Future with Single Stock Futures

As the market navigates the uncertainties of December and ventures into the promising yet unpredictable terrain of 2024, the role of single-stock futures becomes increasingly significant. The flat start to December prompts reflection on the sustainability of the November rally, while the cautionary notes from Wall Street underline the importance of strategic decisions in the coming months.

In the ever-changing landscape of financial markets, where index futures, hot futures, and managed futures vie for attention, investors are tasked with the challenge of deciphering the signals and making informed choices. Whether it’s the resurgence of Disney shares, the discussions around potential streaming bundles, or the reinstatement of dividends after a three-year hiatus, the interconnected web of financial instruments shapes the narrative of the market’s journey.

As we embark on this financial odyssey, single stock futures stand as both a compass and a sail, guiding investors through the changing winds of the market. The path ahead may be uncertain, but with a keen understanding of the dynamics at play, investors can confidently navigate the future, armed with the insights derived from the intricate dance of single stock futures in a world of evolving possibilities.

The post Single Stock Futures in a Changing Market Landscape appeared first on FinanceBrokerage.