Deciphering Economic Factors: Unveiling US’s Perception Gap

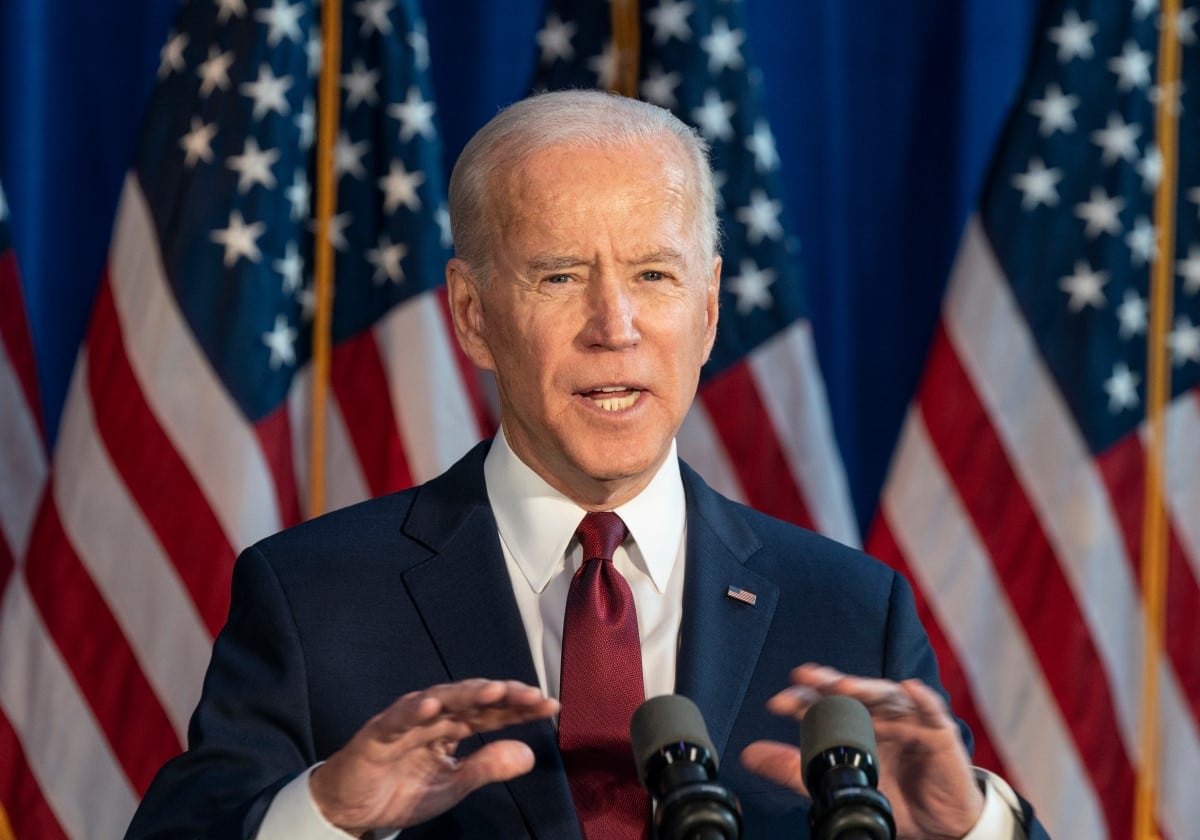

Amidst an economy teeming with growth and optimism, a cloud of uncertainty hangs over the United States. Despite impressive economic factors, a majority of Americans, 58% to be precise, believe that President Joe Biden’s policies have made economic conditions worse, according to recent polls. This stark perception gap raises the question: What’s causing this pessimistic sentiment?

The Economy’s Turnaround

To appreciate the current economic landscape, it’s essential to remember where it all began. When President Biden took office in January 2021, the United States was grappling with an economy in turmoil. Unemployment stood at a daunting 6.3%, and the nation was still reeling from the impact of the COVID-19 pandemic. It was, in the words of Justin Wolfers, a professor of public policy and economics at the University of Michigan, “one of the worst economic moments” in recent history.

Fast forward two and a half years and the transformation is striking. Unemployment has consistently hovered around 3.5%, near its lowest point in fifty years. August marked the 32nd consecutive month of job growth, and real wages are rising, sparking consumer confidence and spending.

A Discord Between Reality and Perception

Despite these remarkable improvements, a glaring disconnect between economic factors and public perception persists. As stated by Wolfers, there exists a substantial gap between reality and perception, one of the most significant he has encountered in his career. If you had fallen asleep in 2019 and woken up in 2023, you would find an economy that matches your expectations.

Inflation, Housing, and Politics: The Economic Factors at Play

So, why the gloomy outlook? Inflation, housing, and political divisions are the primary drivers of this disconnect.

Inflation soared to painful levels in 2021 and 2022, leaving households worldwide grappling with rising prices. In the United States, inflation peaked at a staggering 9.1% in June 2022. Though it has improved since, prices remain roughly 18% higher than in late 2019 before the pandemic.

Gas prices, particularly volatile, added to the discomfort, climbing back up in late August to near pre-pandemic levels.

Meanwhile, housing affordability hit historic lows, with mortgage rates exceeding 7%, a stark contrast to the record low of 2.65% during Biden’s inauguration. The median US home price surged from $258,000 in 2019 to $416,100.

The Political Factor and Economic Plan

The polarized political climate also plays a significant role in colouring perceptions of the economy. Recent polls show that both Republicans and Democrats are disillusioned with President Biden’s handling of the economy. The issue goes beyond evaluating economic conditions, reflecting sentiments towards the president himself.

In a landscape where facts clash with feelings, the challenge for President Biden is clear: bridging the perception gap and finding a way to communicate accomplishments in a less politically charged context.

The path to economic sustainability and a more balanced perspective remains uncertain as the nation navigates these economic factors. Nonetheless, it’s essential to acknowledge that amidst the turbulence of political divisions and fluctuating perceptions, the United States continues to boast one of the fastest-growing economies globally, a testament to its resilience in the face of adversity.

The post Deciphering Economic Factors: Unveiling US’s Perception Gap appeared first on FinanceBrokerage.