USDCHF and USDJPY: USDCHF bounced back to the 0.88000 level

USDCHF continued its bullish consolidation during the first part of August. The pair USDJPY rose to 146.56 levels yesterday, forming a new ten-month high.USDCHF chart analysis

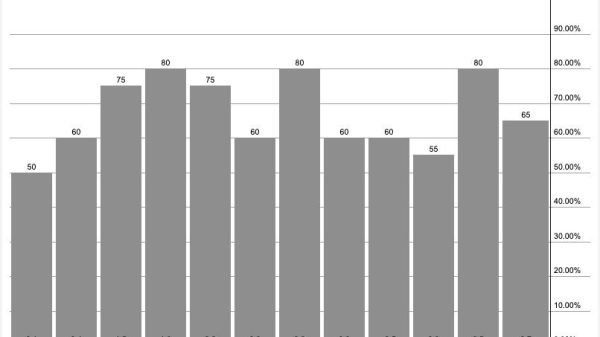

USDCHF continued its bullish consolidation during the first part of August. We have good support in the EMA50 moving average, which supports the dollar. During the Asian trading session, the pair received support at the 0.87760 level and started a new bullish consolidation. We are now at the 0.88000 level and could expect to see a break above.

Potential higher targets are 0.88250 and 0.88500 levels. We need a negative consolidation and pullback below this morning’s support at the 0.87760 level for a bearish option. Thus, we would pull back below the EMA50 moving average, which could put additional pressure on the USDCHF to slide even lower. Potential lower targets are 0.87500 and 0.87250 levels.

USDJPY chart analysis

The pair USDJPY rose to 146.56 levels yesterday, forming a new ten-month high. There, we encounter resistance, and the pair begins to retreat. During the Asian trading session, USDJPY dropped to the 145.15 level and managed to hold above it and form a new bottom. After that, we moved to the 145.50 level and stopped there.

We need a break above if we want to see further recovery and continuation to the bullish side. Potential higher targets are 146.00 and 146.50 levels. We need a negative consolidation and a drop below the 145.00 support level for a bearish option. Potential lower targets are 144.50 and 144.00 levels.

The post USDCHF and USDJPY: USDCHF bounced back to the 0.88000 level appeared first on FinanceBrokerage.