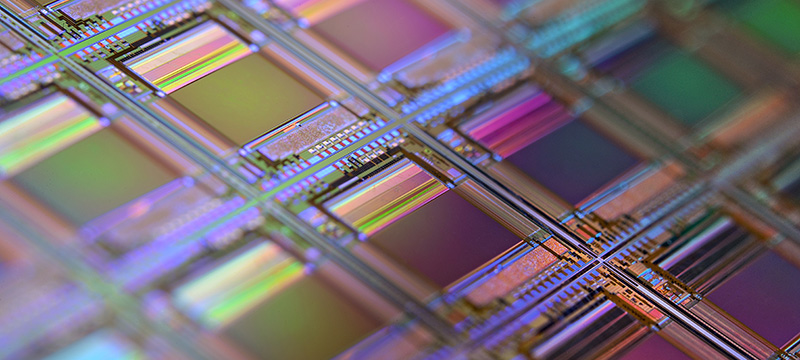

The Semiconductor Industry: Threatening IoT’s Future?

The Internet of Things (IoT) has become increasingly vital in our interconnected world, where technological devices enable our everyday lives. Today, there is an expectation that products will seamlessly connect and operate without difficulty. Popular devices that rely on IoT connectivity include smart home devices, wearables, industrial sensors used in manufacturing and agriculture, patient monitoring devices, medication dispensers, and smart appliances. Each of these requires semiconductors to power their operations and enable connectivity. The full potential of IoT heavily depends on the availability of these semiconductors to meet current and future demands; these industries are inextricably linked. Thus, the ongoing challenges within the semiconductor industry pose a long-term threat to IoT functionality, and its stability significantly impacts device availability, innovation, cost, scalability, and seamless connectivity between IoT devices. Any disruption in this supply chain could wreak havoc on IoT’s growth, development, and adoption.

The Forecast for 2023 and Beyond

The global economy has felt the impact of the chip shortage which affected nearly every industry including hyperscale, enterprise, automotive, telecom, security, industrial, medical, energy, and lifestyle. While many believe the electronic component constraints of the past few years are resolved, the underlying issues that affected the production and supply of chips have not been corrected for the near term, which will impact IoT’s acceleration.

Despite some improvements in chip production and supply, an inventory imbalance remains due to increased buying and forced delivery from long-term agreements signed during the component shortage. Original equipment (OEMs) and contract manufacturers currently have a surplus of certain electronic components but still lack crucial parts needed to complete production. In addition, many companies are sitting on the sidelines, in some cases, taking a wait and see attitude, which has led to a slowdown in production in the first half of 2023 due to economic uncertainty. The expectation therefore is that companies will continue to spend much of 2023 trying to absorb or sell surplus inventory.

With the IoT industry expected to grow exponentially through 2030, we will witness a new technological super cycle with EV, AI, IoT, 5G and the next generation of PCs as the major drivers. This will lead to an explosive surge in demand for semiconductors, especially IoT’s essential components like microcontrollers, processors, memory chips, and wireless communication modules. However, challenges in IT infrastructure buildout to meet these orders will create unpredictability through 2025 and may significantly impact IoT adoption.

The Challenge of Tomorrow

In response to the semiconductor supply chain challenges, new fabrication facilities are being constructed globally, including in the U.S., to ease the pressure during this technological renaissance. Yet, ongoing supply chain volatility is expected as these facilities will not be fully operational for several years and are expected to focus production on the more advanced nodes required by next-generation technologies. Older chips will remain in high demand for products with longer lifecycles in critical industries like medical and automotive, and currently it is unclear how production will ramp up for these components. Additionally, greater visibility into component needs of new product development is necessary.

The fact remains, if the electronic components required to meet this escalating demand for IoT devices are not readily available, we will see increased delivery times and new product introduction slowed, which will impact IoT’s growth.

Until we know what semiconductors will be required to support future technologies, we will not have clear insight into demand, making it difficult for chip manufacturers to plan for the proper mix. Once component needs have been identified, there will be a better understanding of the supporting elements needed to stabilize the supply chain.

Remaining Vigilant in a Rapidly Changing Landscape

Semiconductor manufacturers will continue investing in research and development to keep pace with evolving IoT needs. These investments will drive advancements in fabrication techniques, wireless communication, energy efficiency, security, and processing capabilities. But despite additional manufacturing efforts, supply chain volatility, component constraints, and inventory mix issues are expected to persist until 2030.

For OEMs and other executives leveraging IoT, continuous planning, monitoring, and adjustment are crucial. This technological revolution will demand constant adaptation and flexibility, and those who can adjust will have a clear competitive advantage.

The post Semiconductor Industry’s Impact on IoT: Navigating Challenges and Ensuring Connectivity appeared first on IoT Business News.