Market turbulence looms in the face of infltion

The world of finance is never without its twists and turns, with new developments happening almost every minute.

Recently, all eyes have been on the US dollar, which has faced a decline in the forex market. The dollar index has dropped to a seven-day low due to various factors, including the expected release of inflation data and the ongoing crisis surrounding the debt ceiling.

Get ready to uncover the reasons behind the US dollar’s recent downfall! You don’t want to miss out on this insightful journey into finance!

Implications for Investors and Traders

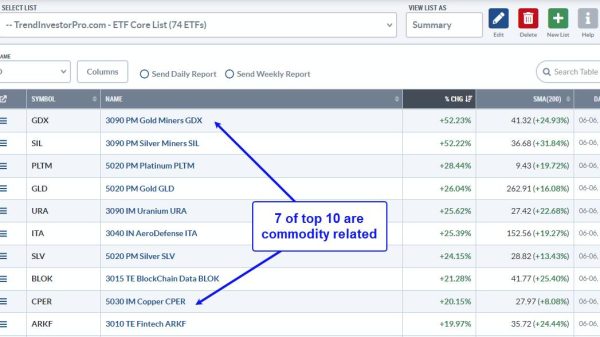

For investors and traders, the changing landscape of reserve currencies presents both risks and opportunities.

As the dollar weakens, other currencies may rise in prominence, providing opportunities for those who invest in those currencies. However, a weaker dollar can also lead to higher inflation, which can erode the value of investments denominated in dollars.

As such, it is important for investors and traders to carefully consider the implications of a changing reserve currency landscape and adjust their strategies accordingly.

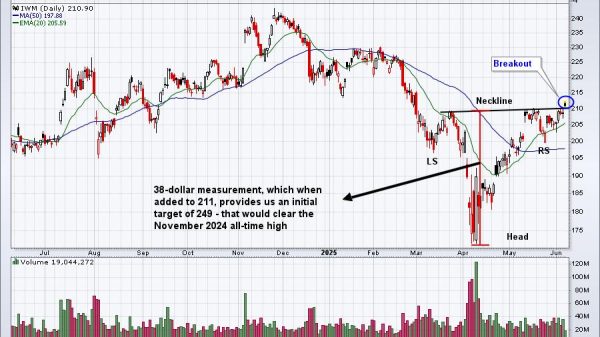

Dollar Eases Amidst Inflation Data Release

The anticipation of the inflation data has caused a stir in the forex market, weakening the dollar. Investors are worried that inflation may exceed expectations, which could result in a decline in the value of the US dollar. The US Federal Reserve has already expressed concerns over rising inflation and is closely monitoring the situation.

Debt Ceiling Impasse Adding to Dollar Woes

Lawmakers in the US are currently facing a crisis regarding the debt ceiling, with negotiations ongoing to raise the limit. Failing to do so could result in consequences for the US economy, including the possibility of defaulting on debt payments. This uncertainty has further weakened the position of the US dollar in the forex market.

Impact of the currency war between China and the US on the global economy

The currency war between China and the US has far-reaching implications for the global economy. As the 2 largest economies in the world, any conflict between them can significantly impact other countries.

The trade war has already resulted in higher prices for consumers in both countries and has caused disruptions in supply chains worldwide. It has also led to a slowdown in global economic growth, with the International Monetary Fund downgrading its forecast for global growth in 2020 and 2021.

In addition, the currency war has caused uncertainty in financial markets, with investors unsure of how to navigate the rapidly changing landscape. The US dollar and the yuan have both been affected, with the value of the yuan dropping in response to the US tariffs. This has caused concern among other countries who fear they, too, may become involved in the conflict.

The US dollar is facing a challenging time, with the inflation data release and the debt ceiling crisis causing major concerns for investors. The situation remains uncertain, and investors are advised to closely monitor developments in the forex market.

The post Market turbulence looms in the face of infltion appeared first on FinanceBrokerage.