Ripple and Tron: Tron in pullback since Saturday

Ripple price pulled back to the 0.5464 support level on Sunday evening. The price of Tron rose to 0.129774 level on Saturday.Ripple chart analysis

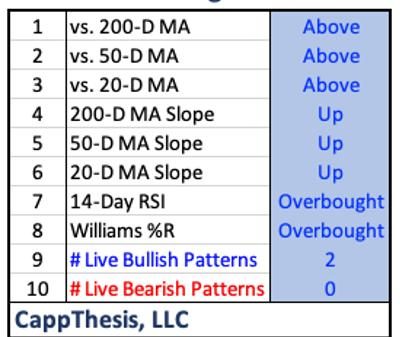

Price of Ripple pulled back to the 0.5464 support level on Sunday evening. On Monday, a bullish consolidation was initiated from that level to 0.5800. So far this week, we have resistance at that level and are holding below. Today’s movement is in the 0.5600-0.5750 range. To continue to the bullish side, we need further bullish consolidation.

With that step, Ripple would eliminate the sideways trend and could consider continuing on the bullish side. Potential higher targets are the 0.5900 and 0.600 levels. For a bearish option, we need a negative consolidation and a drop back to the 0.5500 support zone. A visit to that zone could trigger an impulse below to a new weekly low. Potential lower targets are the 0.5400 and 0.5300 levels.

Tron chart analysis

The price of Tron rose to 0.129774 level on Saturday. There, we encountered new resistance, and the previous bullish momentum was lost. On Sunday, we saw a bearish consolidation to the 0.127500 level. The price met the EMA 200 moving average at that level, stopping further pullback. On Monday, Tron tried to initiate a bullish consolidation but was stopped at 0.128200. From there we started to continue on the bearish side and break the support in the EMA 200.

This morning, Tron’s price fell to a new weekly low at 0.125681. From this support level, we see a recovery to 0.126785. We have tested the daily open price here, and so far, we are unable to move above it. It is possible that we will see a strengthening of the bearish momentum and the initiation of a bearish consolidation. Potential lower targets are the 0.125500 and 0.125000 levels.

The post Ripple and Tron: Tron in pullback since Saturday appeared first on FinanceBrokerage.