Piper Sandler has upgraded Robinhood Markets (NASDAQ: HOOD) to an “Overweight” rating from “Neutral,” and increased their price target from $20 to $23.

This adjustment suggests a potential upside of over 28% from the stock’s current trading price, presenting an attractive entry point after a 27% pullback from its 52-week high on July 16.

This bullish outlook reflects optimism about Robinhood’s prospects amidst ongoing market fluctuations.

Strong Q2 performance boosts investor confidence

Robinhood Markets reported impressive financial results for Q2, surpassing both revenue and earnings expectations.

The company achieved a GAAP EPS of $0.21, exceeding estimates by $0.06, and generated $682 million in total revenue, marking a substantial 40% increase year-over-year.

Key drivers of this growth include a 43% rise in options revenue and a remarkable 161% surge in cryptocurrency revenue.

Additionally, net interest revenue grew by 22% year-over-year, attributed to increased interest-earning assets and higher short-term interest rates.

Despite these positive financial indicators, Robinhood saw a drop in monthly active users, declining from 13.7 million to 11.8 million.

This decrease reflects challenges in user engagement amid a volatile market environment.

Analyst upgrades and market sentiment

Recent upgrades from other analysts further reflect a mixed but generally positive outlook for Robinhood.

On August 5, 2024, Citi upgraded the stock to “Neutral/High Risk” from “Sell/High Risk,” citing improvements in deposits and trading activities following a 12% slump in the stock.

Similarly, Wolfe Research upgraded Robinhood to “Outperform” on June 26, 2024, forecasting a robust +30% GAAP EPS growth supported by strong net deposit and account growth.

However, there remains some caution among analysts regarding potential headwinds.

Concerns about interest rate cuts could pressure Robinhood’s net interest income, contributing to a mixed consensus on the stock’s future performance.

Robinhood’s expansion into cryptocurrency trading

Robinhood’s recent strategic moves underscore its growth trajectory.

The company’s expansion into cryptocurrency trading and its acquisition of Bitstamp enhanced its market presence, particularly in Europe and Asia.

Bitstamp’s global footprint and compliance track record provide Robinhood with a strategic advantage in these regions.

Additionally, the acquisition of Pluto Capital is expected to bolster Robinhood’s AI capabilities, offering more personalized investment strategies and potentially increasing user engagement and retention.

These developments align with Robinhood’s focus on product innovation and market expansion, crucial for attracting and retaining users.

Currently, Robinhood’s forward Non-GAAP P/E ratio stands at 23, higher than the sector median, reflecting the market’s anticipation of the company’s growth potential.

However, some analysts view this valuation as contentious, citing risks related to Robinhood’s reliance on interest income.

The primary risk involves potential interest rate cuts, which could impact Robinhood’s net income given its significant revenue derived from interest.

Additionally, volatility in cryptocurrency trading volumes presents another risk, potentially affecting transaction revenues.

Can remain weak in the medium term

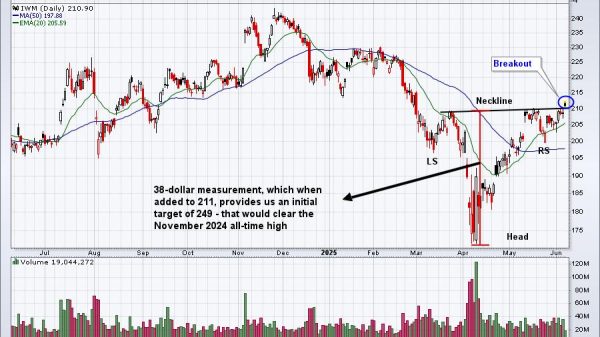

Following its much-celebrated IPO in July 2021, Robinhood’s stock made an all-time high above $80 immediately and then crashed 90% to below $9 by July 2022. Then, the stock largely remained rangebound between $8 and $14 for more than a year.

HOOD chart by TradingViewAfter retesting its support below $8 in November 2023, the stock witnessed a rapid threefold surge to above $24 last month. Since then it has retraced significantly and broken below its medium-term bullish trendline as can be seen in the charts.

Although the stock has bounced back above that trendline in the last few days, it remains weak on the medium-term charts. Most indicators in the medium term have turned negative and are turning red on the longer-term charts.

Considering that investors who continue to remain bullish on the company, but have not initiated a long position yet, must wait for it to cross above the 100-day moving average and the MACD indicator on the daily timeframe to turn positive before initiating fresh long positions.

Traders who continue to remain bearish on the stock must try to short it closer to the $20 level with a stop loss at the recent high of $21.30. If the bearish momentum remains the stock will find it hard to trade above $20 and can again retest support near $14 where one can book profits.

The post Piper Sandler raises Robinhood’s rating to ‘Overweight’ and price target to $23: Should you buy? appeared first on Invezz