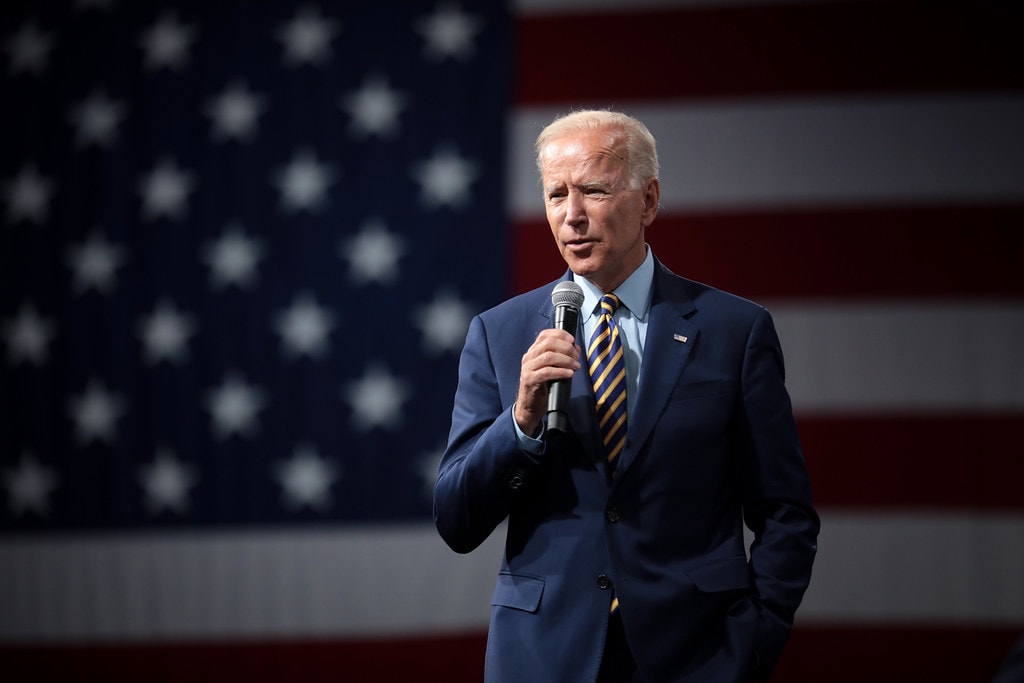

United States President Joe Biden marked the second anniversary of the CHIPS and Science Act by highlighting the significant strides the US has made in semiconductor manufacturing.

The legislation, passed in 2022, aims to revitalise domestic chip production and bolster the nation’s position in advanced technologies like artificial intelligence (AI). Biden’s remarks underscore the impact of the Act, which has led to substantial investments and job creation in the semiconductor industry.

From 10% to 30%: US chip production targets for 2032

In the years leading up to the CHIPS Act, the US witnessed a steep decline in its share of global semiconductor production.

Once accounting for 40% of the market, the country’s contribution dwindled to just 10%. The CHIPS and Science Act was introduced as a response to this downturn, aiming to reclaim the US’s leadership in the semiconductor sector.

Biden noted that, thanks to the Act, the US is now projected to manufacture nearly 30% of the global supply of leading-edge chips by 2032, a significant leap from the negligible figures seen just two years ago.

This ambitious goal reflects a broader strategy to ensure that the US remains competitive in emerging technologies, particularly AI, which relies heavily on advanced semiconductor chips.

The shift towards increased domestic production is not only about securing supply chains but also about maintaining technological leadership in an increasingly digital world.

$400 billion in semiconductor investments

Since the enactment of the CHIPS and Science Act, the US has seen a surge in investments from firms eager to capitalise on the incentives provided by the legislation.

Biden highlighted that these companies have announced investments totalling $400 billion in semiconductor manufacturing facilities across the country.

These investments are critical in expanding the domestic chip production capacity, reducing reliance on foreign suppliers, and securing the supply chain for essential technologies.

The influx of capital into the semiconductor sector has also translated into significant job creation. According to Biden, the industry has already generated 115,000 manufacturing and construction jobs, providing a much-needed boost to the US economy.

These jobs are not only for the semiconductor industry but also for the broader manufacturing sector, which has seen a resurgence in activity as a result of these investments.

The road ahead: Challenges and opportunities

While the progress made in the past two years is commendable, challenges remain on the road to achieving the US’ ambitious semiconductor production goals. Building the infrastructure required for advanced chip manufacturing is a complex and time-consuming process.

It involves not only constructing state-of-the-art facilities but also ensuring a skilled workforce is available to operate them.

Moreover, global competition in the semiconductor industry is fierce, with countries like China and South Korea also ramping up their production capabilities.

The success of the CHIPS and Science Act will depend on how effectively the US can maintain its technological edge while navigating these competitive pressures.

Looking forward, the CHIPS Act’s long-term impact will hinge on sustained investment, continuous innovation, and strong public-private partnerships.

As the US aims for 30% of global chip production by 2032, the journey will require coordinated efforts across government, industry, and academia to address the challenges and seize the opportunities that lie ahead.

The post Biden marks two years of CHIPS Act as US aims for 30% global chip production by 2032 appeared first on Invezz