Ethereum continues to hold above weekly support at $3250

On Monday, the price of Ethereum stopped at the $3396 level.Ethereum chart analysis

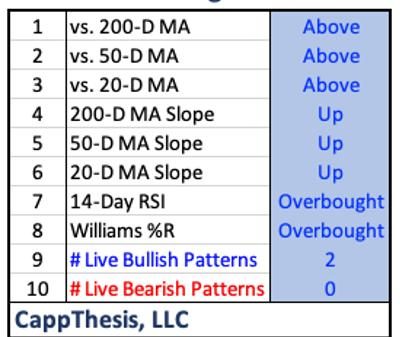

On Monday, the price of Ethereum stopped at the $3396 level. We were a little short of climbing up to the $3400 level. The price lost momentum there and turned to the bearish side. After that, a bearish consolidation was initiated until the first support at $3250. There, we tested the weekly open price and started a new recovery on Tuesday. We only managed to climb up to $3365 because we didn’t have the strength to go any further.

This led to a new pullback and the formation of the weekly low last night at the $3235 level. After that, the price of Ethereum stabilized for the second time and returned to above the weekly open price of $3300. The current bullish consolidation continues to push the price to the $3330 level, where it will try to gain support from the EMA 200 moving average.

Ethereum price is under pressure at $3400 and needs stronger momentum to move above

With new support from this moving average, Ethereum could first attack yesterday’s high at $3365. By winning that peak, the price will have good momentum for further continuation to the bullish side. Potential higher targets are $3375 and $3400 levels. By crossing above $3400, we are going to a new weekly high and could continue towards last week’s high.

For a bearish scenario, the Ethereum price should trigger a bearish consolidation and move back down to the weekly open price. This level is of utmost importance because, with a downward impulse from here, we shift to the negative side. The formation of a new weekly lower low confirms bearish pressure and signals a potential further pullback. Lower targets to watch for are the $3200 and $3175 levels, keeping the audience well-informed about the potential market movements.

The post Ethereum continues to hold above weekly support at $3250 appeared first on FinanceBrokerage.