What Is Bionano Genomics & BNGO Stock?

Bionano Genomics is a genomic company that provides optical genome mapping solutions for translational, basic, and clinical research applications. Its stock is traded on the NASDAQ exchange under the ticker symbol BNGO.

Using Lineagen, Inc., the company offers screening tests for patients with symptoms consistent with neurodevelopmental disabilities, such as autism spectrum disorder.

Additionally, it provides a platform-neutral software solution that combines microarray data (a technology that studies many genes at once) and sequencing data (reading the order of DNA or RNA) to offer a comprehensive view for the analysis, interpretation, visualization, and reporting of single-nucleotide variations (small changes in the DNA sequence), copy number variations (changes in the number of gene copies), and loss of heterozygosity (loss of genetic diversity) throughout the genome.

The company also uses its isotachophoresis (a technique for separating molecules) technology to provide purification solutions and nucleic acid extraction (isolating DNA or RNA from samples). The Saphyr system is one of the OGM systems the company markets and sells. It provides OGM data to allow ultra-specific and ultra-sensitive findings of all structural variations.

The entire biotech field is advancing rapidly, with AI playing a crucial role in boosting the market by providing more precise and comprehensive genetic insights.

BNGO Stock Forecast

The stock price prediction for Bionano Genomics for tomorrow is $0.59845, indicating a 0.52% decrease from the current price. Furthermore, the BNGO stock price is expected to drop by 0.12% to reach $0.60089 the following week.

Regarding the long-term Bionano Genomics stock forecast, these are the current projections (based on BNGO’s 10-year average increase):

The stock prediction for BNGO in a year is $5.08 (745.19%). The 2025 stock forecast for Bionano Genomics is $0.803256 (28.11%). The forecast for BNGO stock in 2030 is $2.77 (342.10%).According to BNGO stock analyst ratings, the stock price has a 686.28% upside potential. Bionano Genomics Inc. has an average price target of $4.93. This is based on Wall Street analysts publishing three 12-month price targets within the last three months.

The lowest estimate is $2.00, while the maximum genome analysis price target is $6.80. The average cost target represents an increase of 686.28% over the current price of $0.627.

Given the potential in this field, we should expect good long-term growth prospects for BNGO stock.

Stock Data

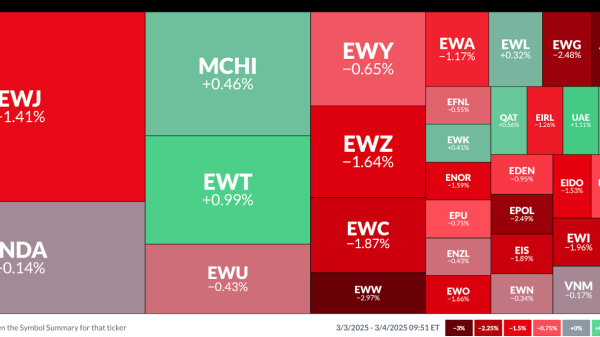

BNGO/USD 5-Day Chart

1 Year Target: $6.00 Today’s High/Low: $0.6300/$0.5921 Share Volume: 1,117,618 Average Volume: 1,555,802 Previous Close: $0.6016 52 Week High/Low: $6.189/$0.52 Market Cap: 41,919,216 P/E Ratio: 0 Forward P/E 1 Yr.: -0.32 Earnings Per Share (EPS): $-6.96 Technical Analysis: 5-day moving average, 20-day moving average, 50-day moving average, 200-day moving averageWhat Happened to BNGO Stock

While the market sentiment for BNGO stock is generally positive, several factors are influencing varying sentiments among investors. A significant shift in the C-suite caused the sharp decline in the BNGO share price on Monday.

Investors pulled out of the biotech stock after it announced that its CFO was stepping down, causing the stock to close more than 13% lower. This resulted in a performance that was very different from the S&P 500 index, which increased by nearly 6%.

When Bionano released its second-quarter earnings earlier this month, it revealed an encouraging increase in revenue year over year but also reported a growing net loss of more than $38 million.

Even more concerning, the company implemented a 1-for-10 reverse stock split. This financial engineering tactic is usually interpreted as an effort by a struggling business to increase the value of its stock.

If you’re looking to diversify your assets, BNGO could be a good investment because of the demand in the field.

Where to Buy BNGO Stock

You can buy Bionano Genomics (NASDAQ: BNGO) stock through a brokerage exchange or on Public. Here is a guide on how to buy the stock on Public:

Register: Sign up on Public to open a brokerage account. Fund Your Account: Deposit funds into your Public account. Decide on Investment: Determine how much you want to invest in BNGO stock.The post BNGO Stock: BioNano Genomics Analysis and Forecast appeared first on FinanceBrokerage.