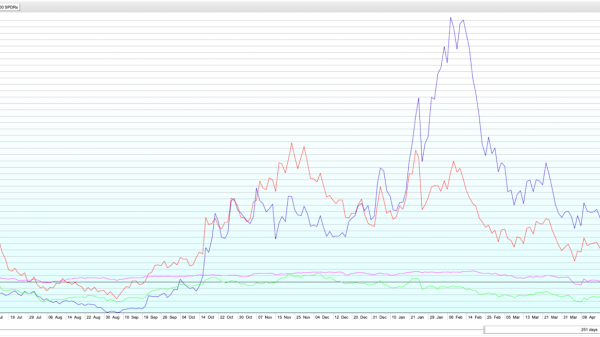

United Parcel Service Inc. (NYSE:UPS) reported its Q2 earnings today. The stock is trading down 12% after market open, mainly due to lower-than-expected revenue in its domestic business.

On a more positive note, US volumes increased for the first time in 9 quarters. That wasn’t enough to please the investors though, who continue to sell the stock.

Here are the highlights from the earnings report:

Revenue $21.82 billion, 1.1% below analyst estimates. EPS $1.79 against analyst estimates of $1.99. Net income $1.41 billion, down from $2.08 billion in the same period last year.Domestic business continues to suffer

Revenue in the US domestic package business segment went down 1.9%, with revenue per piece falling by 2.6%. Even though daily volumes went up slightly, they were offset by big declines in both air and deferred volume.

Poor results and a tough business environment have forced the management to lower guidance for the remainder of the year. The company now expects 2024 revenue to come in at $93 billion instead of the $93.25 billion previously expected.

The company reported an increase in volumes for the first time in 9 quarters. The CEO called it a ‘significant turning point’.

This quarter was a significant turning point for our company as we returned to volume growth in the U.S., the first time in nine quarters.

CEO Carol ToméTeamsters deal: a mistake in hindsight

Around this time last year, UPS made a deal with the International Brotherhood of Teamsters Union. The company was able to please the troublemakers with the deal, but the decision of giving lucrative contracts to its workers is now coming back to haunt them.

If the company has indeed managed to increase volumes, then a lower profit suggests they are overpaying their workers. When the deal with Teamsters was brokered, the company knew they were offering lucrative contracts.

6 months after that deal, the company laid off 12,000 employees. It was clear they couldn’t possibly survive paying so much to drivers. It seems the company thought they would, at some point, lower the headcount to bring down their costs.

But a weaker freight demand has now added to their problems. There is a global freight recession going on, with weak pricing in the shipping sector reflecting a weak demand.

Those who were hoping for a positive earning to see if freight demand had improved got a shock. And the exodus of such investors is clearly reflected in the stock price today.

There is some hope for those who still want to hold the stock. The company recently signed a contract with the United States Postal Service.

They were able to snatch that contract from their rival FedEx, which has increased investors’ hopes for a brighter future.

FedEx had made $1.75 billion with the same deal last year. Now that UPS has that contract, it will boost its revenues and might even open the door for further contracts.

The post UPS Q2 earnings prove it overpays its drivers, investors flee appeared first on Invezz