Quick Look:

Sir Keir Starmer aims to transform Britain into the “best place to start and grow a business”. Over-regulation stifles growth, yet the UK retains a strong entrepreneurial spirit. UK pension funds’ exposure to British equities fell from over 50% in 1997 to just over 5% in 2021. Britain leads Europe in the number of unicorns, indicating a vibrant start-up scene with significant growth potential.Due to the country’s ingrained risk-averse culture, Sir Keir Starmer’s aspiration to transform Britain into the “best place to start and grow a business” faces significant challenges. This cautious approach has been nurtured over three decades of regulatory changes. It began with the death of newspaper tycoon Robert Maxwell in 1991. Exposing the looting of employee pensions led to stringent measures to prevent similar scandals.

Historical Context: Britain’s Regulation Rise Since 1991

These regulatory measures have created a vicious cycle of lower returns and stunted growth. Therefore further exacerbated by the 2008 financial crisis, entrenched a risk aversion culture. Since then, efforts to avoid the excesses of 2008 have been understandable. However, there has not been a candid discussion with the public about the costs of such an approach. This gradual build-up of regulations has contributed to an oppressive environment for businesses, with many feeling the incremental tightening without fully understanding the root causes.

Economic Impacts: Over-regulation Stifling Growth

City veteran Lord Spencer has highlighted Britain’s destructive over-regulation, echoing sentiments growing within the business community. Despite this, there is a robust entrepreneurial spirit within Britain, as noted by Michael McLintock. Notably, he asserts that the economic lifeblood of Britain remains strong and that the nation clearly understands what risk entails.

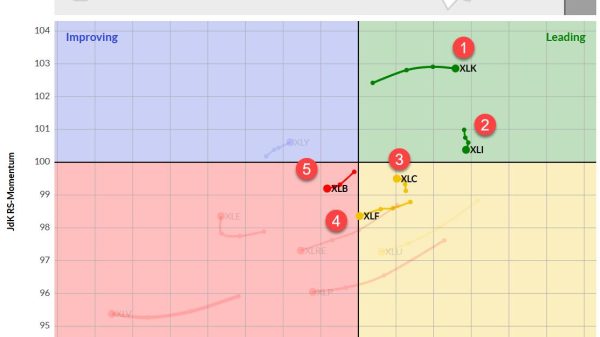

One stark indicator of the shift in risk appetite is the dramatic reduction in UK pension funds’ exposure to British equities. For instance, those have dropped from over 50% to just over 5% between 1997 and 2021. This shift from shares to bonds reflects a broader trend where companies increasingly look towards the US rather than the London Stock Exchange. Additionally, the UK’s critical infrastructure is progressively falling into foreign hands, and the country’s reliance on immigration highlights the lack of domestic capital and investment.

Positive Notes: Britain Leads Europe in Unicorn Start-Ups

However, there are positive signs. Britain boasts the highest number of European unicorns, indicating a vibrant start-up scene. The major challenge lies in scaling these businesses to ensure sustainable growth and economic contribution.

Recent inflation data offers a mixed economic outlook. In May, inflation fell to 2%, the lowest level in nearly three years, down from 2.3% the previous month. This marks the first time the Bank of England’s target inflation rate has been met in almost three years, with notable slowdowns in the price rises of food, soft drinks, recreation, culture, furniture, and household goods. Despite this, inflation peaked at 11.1% in October 2022, largely due to the Russia-Ukraine conflict, and food prices remain significantly higher than at the beginning of 2022. Furthermore, petrol prices are on the rise again.

Political Context: Economy Key Issue Ahead of Britain’s Elections

Certainly, the economy remains a pivotal issue as the general election approaches. The Conservatives are likely to use the latest inflation figures to bolster their narrative of economic recovery, while Labour continues to focus on the ongoing cost of living crisis. The Bank of England’s forthcoming decision on interest rates will also be influenced by these latest economic indicators.

Britain must navigate significant challenges to revive its risk-taking spirit within a heavily regulated framework. Despite the pervasive cautious mindset, the country’s entrepreneurial drive and the presence of numerous unicorns suggest that with the right balance between regulation and risk, there is potential for renewed economic vitality.

The post Reviving Risk-Taking in Britain: Labour’s Crucial Role appeared first on FinanceBrokerage.