The Mode Token Shaved Off Almost 67%. What’s the Forecast?

Quick Look:

Recent Price Volatility: Mode’s token price plummeted 67%, indicating extreme market volatility and leaving it just above its record low. Comparative Performance: The token is lagging behind broader market gains and its sector peers, signalling potential issues in competitiveness. Future Challenges: With the broader market potentially correcting, Mode must adapt strategically to remain relevant, possibly by integrating AI technologies.Mode (Ticker: MODE) has recently undergone a significant price shift. As of today, the token is trading at $0.04885, a sharp decline of nearly 67% from its all-time high of $0.1477 recorded just a day prior, on May 07, 2024. This precipitous drop has left the token 67.66% below its peak and marginally above its all-time low of $0.04748, reached today as well. Such volatility underscores a tumultuous period in the trading history of Mode, marked by extreme highs and lows within a 24-hour trading window.

The token’s market cap currently stands at $62,921,996, ranking it #601 in the global cryptocurrency market. Despite the market downturn, trading volumes have surged by an astronomical 3820.20% in the last 24 hours, indicating a frenetic trading environment which saw the token’s price fluctuating between $0.04748 and $0.1477.

Mode Token Falls to $0.04748, Just Above All-Time Low

Historically, Mode’s performance has been marked by significant volatility, a common characteristic of many digital assets but notable in Mode’s case due to its recent sharp declines and peaks. This pattern is not only pivotal for traders seeking short-term gains but also poses considerable risks for long-term investors due to the potential for sudden financial exposure.

Mode Underperforms Market and Competitors in Recent Drop

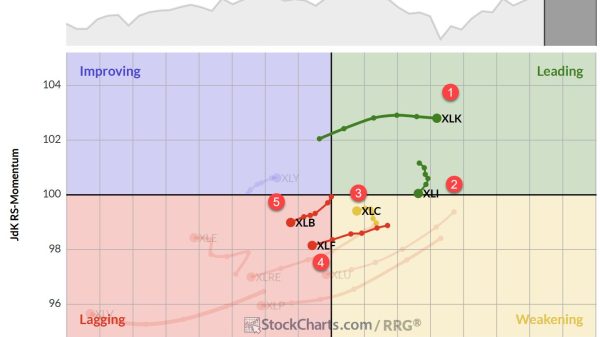

When compared to its peers, the token appears to lag behind the broader market trends. Over the past week, it reported no substantial price change until the recent drop, while cryptocurrencies like Bitcoin and indices such as the CoinDesk 20 have posted gains. Even within the niche of smart contract platforms, where Mode could theoretically find its footing, competitors have seen increases of around 1.6%.

Market Sentiment: Broader Crypto Market Rises 5.3% as Mode Falls

The broader crypto market has risen by 5.30% over the past week. However, this increase diverges significantly from Mode’s trajectory. Notably, specific segments within the market, such as AI-focused cryptocurrencies like Render Network and SingularityNET, have experienced substantial gains. This highlights a growing investor interest in AI-driven blockchain technologies.

Moreover, this trend could hint at where the next wave of crypto-investment might concentrate. It may sideline projects like Mode unless they can pivot to incorporate emerging technologies or narratives that capture investor interest.

Future Strategy: The Token Must Incorporate AI to Stay Relevant

Mode’s immediate future appears challenging. Market analysts suggest a potential correction across the broader market. This correction is driven by shifts in sentiment and profitability dynamics in key cryptocurrencies like Bitcoin.

For Mode, maintaining relevance will require significant strategic adjustments. In particular, the token could align more closely with burgeoning sectors like AI in blockchain. Alternatively, enhancing its underlying technology to foster greater security and efficiency could be another strategy.

External Events: Nvidia, Apple Influence Crypto Sentiment

Upcoming events such as Apple’s ‘Let Loose’ event and Nvidia’s earnings report could indirectly influence investor sentiment in tech and crypto markets. Nvidia is a significant player in AI and computing. It has shown a strong correlation with cryptocurrency market movements, particularly through its involvement in mining rig manufacturing and AI applications. Therefore, any positive developments in these areas could create a spillover effect. This would benefit broader market sentiment and potentially stabilise tokens like Mode.

Market Sentiment: Mode Community Bullish Amid Challenges

Community sentiment around Mode remains bullish despite the market setbacks, with a prevailing greed index indicating a market leaning towards risk-taking. This sentiment, however, could swiftly shift if the market undergoes the anticipated correction. The robust volume traded on exchanges like Gate.io, predominantly in the MODE/USDT pair, illustrates a vibrant trading community that could either buffer the token from further declines or exacerbate volatility depending on broader market movements.

Moreover, Mode faces a plethora of challenges and opportunities. Its ability to navigate the volatile crypto waters will hinge on strategic adaptability and market sentiment. Investors should remain vigilant, considering both the token’s volatile history and the potential for significant market shifts influenced by external economic factors and internal community dynamics. As always, a diversified investment approach in cryptocurrency is advisable, especially in such uncertain times.

The post The Mode Token Shaved Off Almost 67%. What’s the Forecast? appeared first on FinanceBrokerage.