EURAUD and EURNZD: EURAUD in consolidation since yesterday

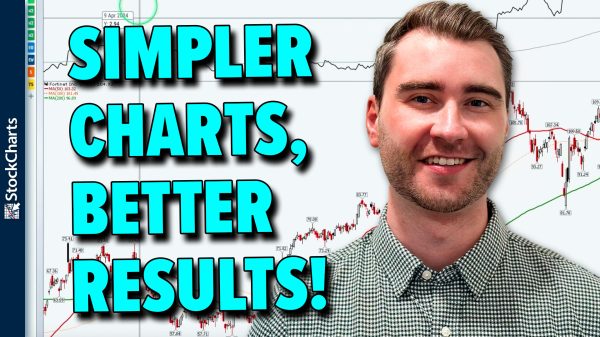

In the first two days of this week, EURAUD moves in the 1.65450-1.65900 range. During the Asian trading session EURNZD climbed to a new weekly high at 1.80724 level.EURAUD chart analysis

In the first two days of this week, EURAUD moves in the 1.65450-1.65900 range. During this morning’s Asian trading session, we tried to put pressure on the upper line but failed to move above it. After that, the pair begins to retreat and falls close to the 1.65500 level. If we don’t get support here, we can expect to see a drop to a new low. Potential lower targets are 1.65400 and 1.65300 levels.

To be bullish, we need a return to the 1.65900 level and above the EMA200 moving average. Then, it needs an impulse above and growth to a new weekly high. With this step, we get rid of the bearish pressure and expect to continue the recovery. Potential higher targets are 1.66000 and 1.66100 levels.

EURNZD chart analysis

During the Asian trading session EURNZD climbed to a new weekly high at 1.80724 level. After that, we stop there and make pullbacks below the 1.80500 level. We did not manage to stop but continued even lower with 1.80000 levels. Here, we find new support and successfully hold the above. We moved up to the 1.80250 level, where we now have resistance at the EMA50 moving average.

This could prevent us from returning to the bullish side and starting a pullback. Potential lower targets are 1.79800 and 1.79600 levels. EMA 200 moving average is in the zone around 1.79500 levels. If we manage to get back above 1.80350 and move above the weekly open price, we will be on the positive side again. After that, we will have an opportunity for a new bullish consolidation. Potential higher targets are 1.80600 and 1.80800 levels.

The post EURAUD and EURNZD: EURAUD in consolidation since yesterday appeared first on FinanceBrokerage.