GBP/USD Plummets 1%, Worst Weekly Drop in 2024

Quick Look

GBP/USD fell nearly 1%, marking its most significant weekly loss in 2024. Tight trading range observed as the pair fluctuates slightly below 1.2750. Key economic indicators to watch: Inflation numbers, PMI, Bank of England’s decision, and British retail sales.The GBP/USD pair recently experienced a notable downturn, nearly 1%, concluding the week with its most substantial loss of the year. As traders and analysts observe the currency pair with bated breath, the beginning of the new week sees GBP/USD meandering in a tight range slightly below the 1.2750 mark.

Rollercoaster Ride: Analyzing GBP/USD’s Recent Performance

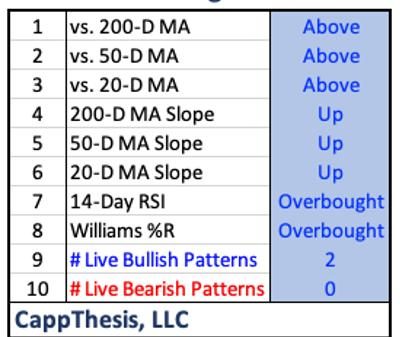

The currency pair’s journey last week was nothing short of a rollercoaster. Firstly, it peaked at a resistance of 1.2893 on Friday, March 8. Subsequently, the GBP/USD exchange rate’s surge to this height met with a pullback. This was prompted by the RSI reaching the overbought threshold of 70. Influenced by unexpectedly robust US inflation data, this retracement saw the pair dip below 1.1750. Despite this setback, the currency duo’s positions above the 50-, 100-, and 200-day moving averages indicate it was just a hiccup in an otherwise intact uptrend.

Technical Analysis

Additionally, the technical analysis further supports this perspective. For example, a descent below the 50-day moving average (DMA) at 1.2686 could indicate a significant trend shift. Moreover, a drop below the 200 DMA at 1.2589 would signal a bearish phase for GBP/USD. Finally, the impending week’s economic releases are critical. These include inflation numbers, the Purchasing Managers’ Index (PMI), the Bank of England’s rate decision, and British retail sales. Together, they are poised to be the main drivers of the pound sterling’s fate.

The Week Ahead: Economic Events to Watch

This week, the spotlight shines on several key economic indicators. The consumer price index (CPI) inflation rate for February is anticipated to fall to 3.6% from January’s 4.0%, with a monthly increase expected at 0.6%, a rebound from the previous month’s decline. These figures serve as a barometer for the economy’s health and as crucial factors influencing GBP/USD’s direction. The pair’s downward correction path hinges on these upcoming data points, with significant support levels at 1.2675 and 1.2600 under the bears’ scrutiny.

Conversely, the pair’s ascendancy relies on overcoming the psychological barrier of 1.3000, which necessitates stability above 1.2830 resistance. This week’s unfolding economic events are pivotal in steering GBP/USD’s course, with market participants bracing for a performance confined to narrow ranges, awaiting reactions to the disclosed indicators.

As GBP/USD navigates the flux of market sentiments and economic indicators, the technical landscape offers a map for potential directions. The current retracement within a broader uptrend underscores the resilience of the pound-dollar exchange rate. Yet, the impending economic events cast a shadow of uncertainty, making the anticipation of the pair’s next moves a complex puzzle.

The post GBP/USD Plummets 1%, Worst Weekly Drop in 2024 appeared first on FinanceBrokerage.