Silver Dips to $24.08 Amidst Market Caution

Quick Look

Silver (XAG/USD) dips by 0.22%, trading at $24.08. Key resistance and support levels highlight a cautious market. Technical indicators suggest a fragile bullish trend under current resistance. Near-term corrections may target static support and moving averages.Silver experienced a marginal decrease of 0.22%, settling at $24.08. This movement positions it below the critical pivot point of $24.27, hinting at a market treading cautiously. Resistance levels at $24.63, $24.89, and $25.18 set a ceiling for potential price ascents. Also, support levels at $23.95, $23.59, and $23.28 aim to cushion any declines. The trading dynamics underscore a market at a crossroads, with investors weighing their next steps amidst bullish and bearish signals.

Silver Below Pivot, EMA Suggests Caution

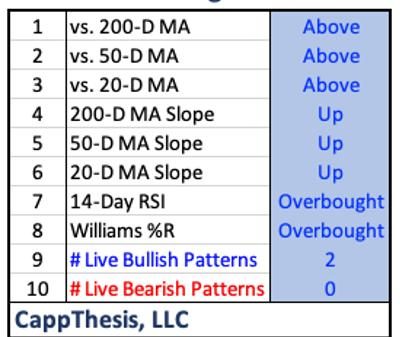

The 50-day and 200-day Exponential Moving Averages (EMAs) stand at $23.94 and $23.27, respectively. This positioning showcases a market that is tentatively leaning towards a bullish stance. However, Silver’s current position below the pivot point offers a contrast, painting a bearish picture. This indicates that investors might be adopting a cautious outlook. Nevertheless, should there be a breakthrough above the $24.27 threshold, it could pivot the market sentiment towards a more optimistic tone. This change would highlight the importance of these levels in influencing trader behaviour. Additionally, this sentiment is not confined to one market alone; both international and domestic markets share similar views. Silver is trading around $24.09 per ounce internationally and has opened at Rs 73,810 per kg on the MCX.

Silver at Crossroads: $25.91 or Corrections?

On Tuesday, Silver showed hesitancy, staying just below key resistance levels that lie between $24.50 and $24.64. Firstly, these points act as critical barriers, and crossing them could trigger a rally towards the next significant milestone, set at the December 4 main top of $25.91. However, due to its close proximity to these resistance levels, Silver is at risk of near-term corrections, aiming for a static support level at $23.55. Additionally, further supports, indicated by the 50-day EMA at $22.96 and the 200-day EMA at $23.29, mark additional points where declines may find a halt. Consequently, these dynamics emphasize Silver’s delicate balance as it fluctuates between bullish hopes and bearish pressures.

Furthermore, Silver’s minor downturn underscores a cautious market sentiment, highlighted by resistance and support levels that mark the conflict zone for bulls and bears. The technical indicators, meanwhile, reveal the underlying trends, pointing to a tender bullish trend amidst bearish forces. As Silver walks this fine line, its capacity to break through key resistance or give in to corrections becomes a central concern for investors. Ultimately, the interaction between these elements is expected to define Silver’s short-term path, rendering it a focal point for those keen on the subtleties of precious metals trading.

The post Silver Dips to $24.08 Amidst Market Caution appeared first on FinanceBrokerage.