Solana’s Resilient Rise: Aiming Beyond $175

Quick Look

Solana demonstrates resilience with a base formation above the $130 support zone, igniting a fresh upward trajectory. The cryptocurrency experiences a significant uplift, ascending past the $150 mark alongside market giants like Bitcoin and Ethereum. A key resistance awaits at $162.50; overcoming this could herald a new wave of increases, potentially reaching $175 or beyond.Solana (SOL), a distinguished player in the cryptocurrency realm, has recently showcased its robustness by securing a solid base above the $130 support zone. This foundational stability catalyzed a promising ascent, steering the price through critical levels at $135 and $145. The momentum did not stop there; Solana’s valuation soared by nearly 10%, surpassing the $150 milestone. This rally mirrors the positive movements observed in other leading cryptocurrencies, such as Bitcoin and Ethereum, underscoring broader market optimism.

Solana’s Bullish Surge: Targets $175 and Beyond

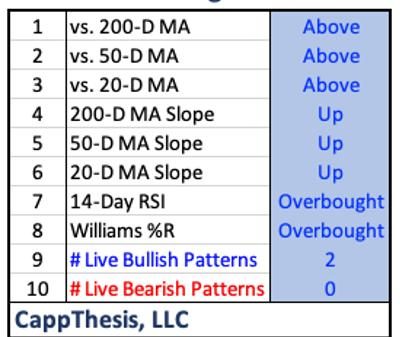

The technical landscape for Solana paints a bullish picture. Currently trading above $150, the digital asset also floats above the pivotal 100 simple moving average (SMA) on the 4-hour chart, an indicator often associated with bullish market sentiment. A connecting bullish trend line, with its support at $140, further accentuates the upward trajectory of the SOL/USD pair. Resistance levels lie in wait, with the immediate hurdle positioned near $156.50. Surmounting this, the next significant barrier at $162.50—or the 1.618 Fibonacci extension of a recent pullback—beckons. A decisive break above this threshold could set the stage for an accelerated rally, targeting the $175 mark and possibly extending towards $180.

Correction Risks Loom at $162.50 Resistance

Despite the prevailing bullish outlook, potential corrections are a concern. Should Solana face resistance at the critical $162.50 juncture, a setback may occur. Consequently, this could lead to a test of the initial support levels around the $150 area. Furthermore, a deeper pullback could target the first major support near $142.00. Additional pressure might drive the prices down to the $138.00 mark and the supportive trend line. If prices breach this level, Solana could fall towards the $128.00 support. Alternatively, it might even retest the 100 SMA (4 hours). This scenario illustrates the delicate balance between bullish aspirations and market realities.

Solana’s recent price activity highlights its strength and potential for growth within the cryptocurrency world. The digital asset faces immediate resistance levels that pose challenges. Nonetheless, the overall bullish indicators and market sentiment paint a promising picture for Solana. Therefore, investors and enthusiasts should stay alert. The market’s volatile nature introduces both opportunities and challenges. These factors play a crucial role in shaping Solana’s path forward.

The post Solana’s Resilient Rise: Aiming Beyond $175 appeared first on FinanceBrokerage.