Cardano Soars Past $0.780, Eyes $0.8320

Quick Look

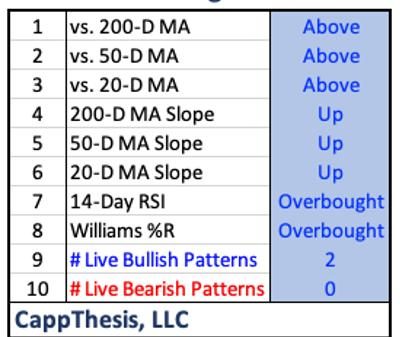

Cardano (ADA) sees a notable rise, surpassing the $0.705 resistance. A significant break above a bearish trend line, with price spikes above $0.780. ADA trades above crucial levels, eyeing the next resistances at $0.80 and $0.8320. Support levels to watch: $0.7380 and $0.6880, with potential dips to $0.6280.This week marked a pivotal shift for Cardano (ADA) as it embarked on a bullish trajectory, climbing above the crucial $0.705 resistance against the US Dollar. The momentum didn’t stop there. The ADA/USD pair dashed through the $0.720 and $0.732 marks, showcasing remarkable strength in buying pressure. The ascent was further solidified by a breakthrough above a key bearish trend line at $0.7220 on the 4-hour chart. This surge propelled the price over the $0.750 barrier, and the bulls didn’t pause, pushing the value to eclipse the $0.780 resistance. At its zenith, ADA touched a high near $0.7884, now entering a consolidation phase to gather strength for possibly more upward movements.

Cardano’s Bullish Surge: Eyes on $0.88 High

As of now, Cardano is not just trading; it’s flourishing well above the 23.6% Fib retracement level from the recent rally from $0.5800 to $0.7884. Its stance above $0.750 and the 55 simple moving average (4 hours) reinforces the bullish sentiment surrounding ADA. Looking upward, the immediate resistance hovers near the $0.7880 zone, with eyes set on the more formidable $0.80 barrier. A decisive break above could open the floodgates toward $0.8320, potentially extending gains to the $0.850 and even $0.880 levels, painting a bullish narrative for the near term.

Cardano’s Bullish Path: Watch Key Supports

Despite the upbeat momentum, Cardano’s price journey faces potential setbacks. Firstly, immediate support is at the $0.7380 level. This serves as a cushion for short-term pullbacks. Furthermore, a more critical support level is near $0.6880. This is the rally’s 50% Fib retracement level, ranging from $0.5800 to $0.7884. If the price slips below this, it could test the $0.6280 mark. Consequently, this introduces a cautionary tone to the bullish narrative. Hence, these levels are crucial. Traders and investors must monitor them, as they could shape ADA’s trajectory in the upcoming weeks.

On another note, Cardano’s recent price action shows robust bullish sentiment. Significant technical breakthroughs and trading volumes support this. As the digital asset moves through these critical levels, maintaining key supports is essential. Indeed, doing so will be pivotal in either sustaining the bullish momentum or facing a corrective pullback. Therefore, investors and traders will closely observe these developments. They are prepared to adjust their strategies based on ADA’s performance against broader crypto market trends.

The post Cardano Soars Past $0.780, Eyes $0.8320 appeared first on FinanceBrokerage.