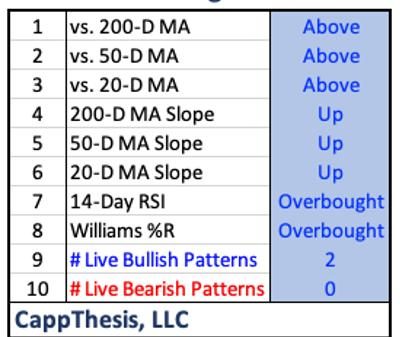

S&P500 and Nasdaq indices: S&P500 goes to new high at 5169,3

The S&P500 index retreated to 5060.0 on Tuesday. The Nasdaq index also had a pullback to 17803.0 levels on Tuesday.S&P500 index chart analysis

The S&P500 index retreated to 5060.0 on Tuesday. After that, we managed to get support at that level and start a bullish consolidation. By crossing above the 5090.0 level, the index received the support of the EMA200 moving average. With new support on Thursday, we saw bullish consolidation and a jump to the 5165.0 level. During the Asian trading session, we saw a short pullback to support at the 5150.0 level.

With a new bullish consolidation from that level, we are climbing today to 5169.3, a new all-time high. We stop at that level and return to 5155.0. Chances are high that we will see a new impulse and jump to a new high. Potential higher targets are 5170.0 and 5180.0 levels. We need a pullback below the 5150.0 support level for a bearish option. With increased bearish momentum, we would be forced to continue the pullback and test lower levels.

Nasdaq index chart analysis

The Nasdaq index also had a pullback to 17803.0 levels on Tuesday. After receiving support, we recovered and returned above the 18300.0 level last night. With this jump, we retest the weekly resistance zone and all-time high at 18339.9. Today’s support of the index value is 18232.0 level and we continue to move in that range between support and ATH.

We need a stronger impulse to take us over and form a new high. Potential higher targets are 18400.0 and 18500.0 levels. For a bearish option, we need a pullback below the daily low. With that step, we move away from our goal and turn to the bearish side. Potential lower targets are 18200.0 and 18150.0 levels.

The post S&P500 and Nasdaq indices: S&P500 goes to new high at 5169,3 appeared first on FinanceBrokerage.