Solana Hits $130 with 14% Surge, Volume Up 127%

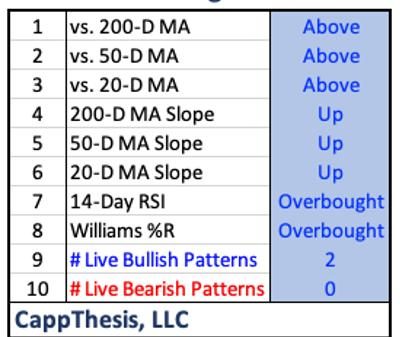

Solana (SOL) sees a 14% price increase, reaching a peak of $130. Trading volume skyrockets by 127%, indicating heightened trader interest. Positioned fifth on CoinMarketCap with a $57 billion market cap. Momentum fueled by the Dogwifhat (WIF) meme coin’s popularity, with a 374% increase since its launch.Solana’s performance has been nothing short of spectacular in the past day. Its chart reveals a bullish pattern. The cryptocurrency soared by over 14%, hitting a $130 peak. This rally isn’t just a number; it marks Solana’s highest value this year. The trading volume also spiked. It grew by more than 127%, reaching $7.59 billion. Such figures reflect a growing trader interest in Solana. Currently, it holds the fifth spot on CoinMarketCap. Its market cap stands at an impressive $57 billion.

Solana’s Breakout: WIF Meme Coin & 40% DeFi Growth Propel Surge

Several factors contributed to Solana’s recent success. After trading between $100 and $110, Solana broke out. It surpassed the $125 resistance despite a brief 5.85% correction. The Solana-based Dogwifhat (WIF) meme coin played a crucial role. Its price jumped 50% in just a few days. Since its December launch, WIF has soared by over 374%. Such buzz has undeniably fueled Solana’s rally.

Moreover, Solana’s DeFi ecosystem saw a 40% TVL increase, ranking fourth in the industry. Crypto expert Santiago Santos shared insights akin to those of Hansolar, highlighting a parallel between Solana and Ethereum’s trajectories. Santos pointed out that Solana is experiencing a phase reminiscent of Ethereum’s ICO boom. However, he posited that Solana’s journey might outshine Ethereum’s, attributing this to its “significant usage and expansion,” contrasting Ethereum’s earlier stage.

Solana Targets $170 Amid Bullish Outlook, Eyes $200 Peak

Solana’s current position is promising. It has reclaimed the pivotal $130 level, setting the stage for potential gains. If the bullish momentum continues, Solana could reach the $170 mark, possibly even $200. However, market dynamics are unpredictable. A reversal could see Solana retracting to the $110 support level. The market’s future movements will likely hinge on continued interest in Solana’s ecosystem and broader market trends.

Solana’s journey through the cryptocurrency markets remains dynamic and intriguing. With its impressive rally, growing trading volume, and buzz around its DeFi ecosystem, Solana is a cryptocurrency to watch. Whether it will continue to ride the bullish wave or face corrections remains a focal point for traders and investors alike.

The post Solana Hits $130 with 14% Surge, Volume Up 127% appeared first on FinanceBrokerage.