Note to the reader: This is the eighth in a series of articles I’m publishing here taken from my book, “Investing with the Trend.” Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of facts. The world of finance is full of such tendencies, and here, you’ll see some examples. Please keep in mind that not all of these examples are totally misleading — they are sometimes valid — but have too many holes in them to be worthwhile as investment concepts. And not all are directly related to investing and finance. Enjoy! – Greg

Real Time vs. History

In regard to financial crises, market meltdowns, and so on, when you actually live through one, it is always amplified to the point you think it is the absolute worst ever. After things have faded into history, it never seems as bad. I’ve been through a bunch of goofy markets, but 2008 seems close to the worst, even though I ‘m sure it isn’t. Being human has some real issues when it comes to the markets. There is an old aviation saying, “It is better to be on the ground wishing you were in the air than being in the air wishing you were on the ground.”

Another crazy human trait is to wish the markets to be fair, but then search, often at great expense, for a way to get an edge and win. Opposing that is when you believe the market is unfair, yet you check your portfolio three times a day (see the section “Cognitive Dissonance” in this chapter).

Behavioral Investing

The term heuristic refers to experience-based techniques for problem solving, learning, and discovery. Where an exhaustive search is impractical, heuristic methods are used to speed up the process of finding a satisfactory solution. Examples of this method include using a rule of thumb, an educated guess, an intuitive judgment, or common sense. Heuristics are strategies using readily accessible, though loosely applicable, information to control problem-solving in human beings and machines. Heuristics is derived from the same Greek root word from which we derive eureka.

Incidentally, the phrase “rule of thumb” has many origins; I’ll pick the one where a man would use his thumb to make various measurements. (If you check the Internet, you can find many other comments about the origin of “rule of thumb.”)

There are some great authors that I particularly like when it comes to reading and understanding behavioral finance and investing. Here is my short list of favorites:

James Montier Tim Richards Hersh Shefrin Thomas Gilovich Martin SewellMost of the following material came from their books (bibliography) or websites. If you haven’t read Montier’s Little Book of Behavioral Investing, you need to, and then read it again once a year. I am often asked for advice from young traders and investors, and the most consistent and most-stressed thing I tell them is to learn about yourself. Understanding behavioral biases will help accomplish that.

Because the efficient market hypothesis is widely criticized, the field of behavior finance/investing has surfaced in the past couple of decades as an alternative. The real advantage of understanding these heuristics is that one can learn about oneself, and hopefully adjust his or her decision making when it comes to investing.

Behavioral Biases

Here are the biases that I think are important for investors to consider (alphabetically listed):

Ambiguity Aversion

• “We don’t mind risk, but we hate uncertainty.” Tim Richards

• “People prefer the familiar to the unfamiliar.” Hersh Shefrin

Anchoring

• Anchoring is a cognitive heuristic in which decisions are made based on an initial “anchor.”

• Reflects the degree to which the initial judgment about an event or situation prohibits one from deviating from that position, regardless of new information to the contrary.

• Psychologists have documented that when people make quantitative estimates, their estimates may be heavily influenced by previous values of the item. For example, it is not an accident that used-car salespeople always start negotiating with a high price and then work down. The salespeople are trying to get the consumer anchored on the high price so that, when they offer a lower price, the consumer will estimate that the lower price represents a good value.

• Anchoring can cause investors to underreact to new information.

• “Our habit of focusing on one salient point and ignoring all others, such as the price at which we buy a stock.” Tim Richards

• “In the absence of any solid information, past prices are likely to act as anchors for today’s prices.” “The stock market has a tendency to underreact to fundamental information— be it dividend omission, initiation or an earnings report.” James Montier

Availability

• It’s different this time!

• Availability is a cognitive heuristic in which a decision maker relies on knowledge that is readily available rather than examining other alternatives or procedures. Th is leads to arguments like, “smoking is not dangerous since my mother smoked two packs a day and lived to 90.”

• “There are situations in which people assess the frequency of a class or the prob.ability of an event by the ease with which instances or occurrences can be brought to mind. For example, one may assess the risk of heart attack among middle-aged people by recalling such occurrences among one’s acquaintances. Similarly, one may evaluate the probability that a given business venture will fail by imagining vari.ous difficulties it could encounter. This judgmental heuristic is called availability. Availability is a useful clue for assessing frequency or probability, because instances of large classes are usually reached better and faster than instances of less frequent classes. However, availability is affected by factors other than frequency and prob.ability. Consequently, the reliance on availability leads predictable biases.” Amos Tversky and Daniel Kahneman

Calendar Effects

• Calendar effects (sometimes less accurately described as seasonal effects) are cyclical anomalies in returns, where the cycle is based on the calendar. The most common calendar anomalies are the January effect and the weekend effect.

Cognitive Dissonance

• “Cognitive dissonance is the mental conflict that people experience when they are presented with evidence that their beliefs or assumptions are wrong.” James Montier

• “The effect of simultaneously trying to believe two incompatible things at the same time.” Tim Richards

Communal Reinforcement

• Communal reinforcement is a social construction in which a strong belief is formed when a claim is repeatedly asserted by members of a community, rather than due to the existence of empirical evidence for the validity of the claim.

• Confirmation bias is a cognitive bias whereby one tends to notice and look for information that confirms one’s existing beliefs, while ignoring anything that con.tradicts those beliefs. It is a type of selective thinking. This is a heuristic common with newsletter writers. Something has caused them to believe the market will do such and such, and then they search for situations and data that support that belief.

• “Confirmation bias is the technical name for people’s desire to find information that agrees with their existing view.” James Montier

Disposition Effect

• “The disposition effect can be explained by arguing that investors are predisposed to holding losers too long and selling winners too early.” Hersh Shefrin

• “Shefrin and Statman predicted that because people dislike incurring losses much more than they enjoy making gains, and people are willing to gamble in the domain of losses, investors will hold onto stocks that have lost value (relative to the reference point of their purchase) and will be eager to sell stocks that have risen in value. They called this the ‘disposition effect.'” James Montier

Endowment Effect

• “This pattern—the fact that people often demand much more to give up an object than they would be willing to pay to acquire it—is called the endowment effect.” Richard Thaler

• “The endowment effect is a hypothesis that people value a good more once their property right to it has been established. In other words, people place a higher value on objects they own relative to objects they do not. In one experiment, people demanded a higher price for a coffee mug that had been given to them but put a lower price on one they did not yet own.” Martin Sewell

• “Both the status quo bias and the endowment effect are part of a more general issue known as loss aversion.” James Montier

• “Simply put, the endowment effect says that once you own something you start to place a higher value on it than others would.” James Montier

Halo Effect

• Experts add little value. Pedigree trumps evidence.

• “The halo effect is a simple, pervasive and powerful psychological bias which sees us anchor onto a single positive feature of a person and then indiscriminately apply it to all of their other traits. So if we perceive someone as physically desirable we’re likely to assume that they’re attractive in all other ways as well. This is highly fortunate for those beautiful but bad tempered, foul mouthed and cerebrally challenged personalities who commonly grace our multimedia world.” Tim Richards

• Companies will often attempt to use the halo effect by getting celebrity endorse.ments from completely unrelated but popular celebrities. Still, trading on such a simple psychological trait would be unlikely to fool savvy investors, you’d think.

Herding

• “Herding behavior or ‘following the trend’ has frequently been observed in the housing market, in the stock market crash of 1987 (see Shiller) and in the foreign exchange market.” Frankel and Froot, Allen and Taylor

• [“The behavior, although individually rational, produces group behavior that is, in a well-defined sense, irrational. This herd-like behavior is said to arise from an information cascade.” Robert Shiller

• “We review theory and evidence relating to herd behavior, payoff and reputational interactions, social learning, and informational cascades in capital markets. We off er a simple taxonomy of effects, and evaluate how alternative theories may help explain evidence on the behavior of investors, firms, and analysts. We consider both incentives for parties to engage in herding or cascading, and the incentives for parties to protect against or take advantage of herding or cascading by others.” Hirshleifer and Teoh

Hindsight Bias

• “The reason for overconfidence may also have to do with hindsight bias, a tendency to think that one would have known actual events were coming before they happened, had one been present then or had reason to pay attention. Hindsight bias encourages a view of the world as more predictable than it really is.” Robert Shiller

• “Hindsight bias: a.k.a Monday morning quarterback.” Nassim Taleb

• This is a common heuristic among investors, especially technical analysts, who see situations in the past and actually think they are making a determination that will affect the future—they quite honestly don’t realize they are doing it.

Loss Aversion/Risk Aversion

• Lose sight of the big picture. Focus on short-term losses. Anchor against most recent values. Underweight more aggressive investments.

• “In prospect theory, loss aversion refers to the tendency for people to strongly prefer avoiding losses than acquiring gains. Some studies suggest that losses are as much as twice as psychologically powerful as gains. Loss aversion was first convincingly demonstrated by Amos Tversky and Daniel Kahneman.”

• “The central assumption of the theory is that losses and disadvantages have greater impact on preferences than gains and advantages.” Amos Tversky and Daniel Kahneman

• “Numerous studies have shown that people feel losses more deeply than gains of the same value.” Amos Tversky and Daniel Kahneman.

• Everyone believes they are above average. An often quoted test is to ask a group of 50 people to raise their hands if they think they are above average drivers. Most times, considerably more than half of them will raise their hands. People also have a tendency to cling to their assertions about things. With investing, overconfidence can lead to underdiversification. James Montier says this is one of the most common biases.

Overreaction

• “[I]nvestors overreact to negative news.” Hersh Shefrin

• “De Bondt and Thaler argued that investors overreact to both bad news and good news. Therefore, overreaction leads past losers to become underpriced and past win.ners to become overpriced.” Hersh Shefrin

• “Rather, what we find is apparent Under-reaction at short horizons and apparent overreaction at long horizons.” Hersh Shefrin

• “What we seem to have is overreaction at very short horizons, say less than one month momentum possibly due to Under-reaction for horizons between three and twelve months (Jegadeesh and Titman) and overreaction for periods longer than one year (De Bondt and Thaler).” Hersh Shefrin

• “The overreaction evidence shows that over longer horizons of perhaps three to fi ve years, security prices overreact to consistent patterns of news pointing in the same direction.” Shleifer

Prospect Theory

• Gains are less intense than losses. People hold onto losses too long. People sell winners too soon.

• “Prospect theory was developed by Kahneman and Tversky. In its original form, it is concerned with behavior of decision makers who face a choice between two alternatives. Th e definition in the original text is: ‘Decision making under risk can be viewed as a choice between prospects or gambles.’ Decisions subject to risk are deemed to signify a choice between alternative actions, which are associated with particular probabilities (prospects) or gambles. The model was later elaborated and modified.” Goldberg and von Nitzsch

• “Prospect theory has probably done more to bring psychology into the heart of economic analysis than any other approach. Many economists still reach for the expected util.ity theory paradigm when dealing with problems, however, prospect theory has gained much ground in recent years, and now certainly occupies second place on the research agenda for even some mainstream economists. Unlike much psychology, prospect theory has a solid mathematical basis—making it comfortable for economists to play with. However, unlike expected utility theory which concerns itself with how decisions under uncertainty should be made (a prescriptive approach), prospect theory concerns itself with how decisions are actually made (a descriptive approach).” James Montier

• “[G]et-evenitis is central to prospect theory,” Hersh Shefrin.

• “[P]rospect theory deals with the way we frame decisions, the different ways we label—or code—outcomes; and how they affect our attitude toward risk.” Belsky and Thomas Gilovich

Recency

• “You overfocus on the most recent events you’ve experienced and neglect to worry about older information. We don’t so much integrate new information with the old as use it to overwrite our memories,” Tim Richards

Representativeness

• Great companies are great investments. People rely on rules of thumb. People see things the way they ought to be.

• “Many of the probabilistic questions with which people are concerned belong to one of the following types: What is the probability that object A belongs to class B? What is the probability that event A originate from process B? What is the probability that process B will generate event A? In answering such questions, people typically rely on the rep.resentativeness heuristic, in which probabilities are evaluated by the degree to which A is representative of B, that is, by the degree to which A resembles B. For example, when A is highly representative of B, the probability that A originates from B is judged to be high. On the other hand, if A is not similar to B, the probability that A originates from B is judged to be low.” Amos Tversky and Daniel Kahneman

• “The best explanation to date of the misperception of random sequences is offered by psychologists Daniel Kahneman and Amos Tversky, who attribute it to people’s ten.dency to be overly influenced by judgments of ‘representativeness.’ Representativeness can be thought of as the reflexive tendency to assess the similarity of outcomes, instances, and categories on relatively salient and even superficial features, and then to use these assessments of similarity as a basis of judgment. People assume that ‘like goes with like’: Things that go together should look as though they go together. We expect instances to look like the categories of which they are members; thus, we expect someone who is a librarian to resemble the prototypical librarian. We expect effects to look like their causes; thus we are more likely to attribute a case of heartburn to spicy rather than bland food, and we are more inclined to see jagged handwriting as a sign of a tense rather than a relaxed personality.” Thomas Gilovich

Selective Thinking

• Selective thinking is the process by which one focuses on favorable evidence in order to justify a belief, ignoring unfavorable evidence.

Self-Attribution

• “Self-attribution bias occurs when people attribute successful outcomes to their own skill but blame unsuccessful outcomes on bad luck.” Hersh Shefrin

• Self-deception is the process of misleading ourselves to accept as true or valid that which is false or invalid.

Status Quo Bias

• The status quo bias is a cognitive bias for the status quo; in other words, people tend to be biased toward doing nothing or maintaining their current or previous decision.

• “The example also illustrates what Samuelson and Zeckhauser (1988) call a status quo bias, a preference for the current state that biases the economist against both buying and selling his wine.” Richard Thaler

• “One implication of loss aversion is that individuals have a strong tendency to remain at the status quo, because the disadvantages of leaving it loom larger than the advantages. Samuelson and Zeckhauser have demonstrated this effect, which they term the status quo bias.” Richard Thaler

• “Both the status quo bias and the endowment effect are part of a more general issue known as loss aversion.” James Montier

Underreaction

• “In predicting the future, people tend to get anchored by salient past events. Consequently, they underreact.” Hersh Shefrin

• The underreaction evidence shows that security prices underreact to news such as earnings announcements. If the news is good, prices keep trending up after the initial positive reaction; if the news is bad, prices keep trending down after the initial negative reaction.

Bias Tracks for Investors

The following is my attempt to tie some of these behavioral biases together and see how they flow from one to another and eventually into technical analysis techniques (italicized).

1. Communal Reinforcement causes Selective Thinking, which causes Confirmation Bias, which can cause Self-Deception, which leads to either Self-Fulfilling or Self-Destructive. If Self-Fulfilling, it can lead to using Price, which can lead to using Support and Resistance. If Self-Destructive, it can lead to using Time, which can lead to using Calendar Effects such as Weekend Effect, January Barometer, January Effect, and so on.

2. Status Quo Bias can lead to Anchoring, which can lead to Support and Resistance. It can also lead to Loss/Risk Aversion, which can lead to Underreaction, which is typically associated with the short term.

3. Self-Deception can lead to Self-Attribution and Overconfidence. Overconfidence can lead to Hindsight Bias and Representativeness. Representativeness can lead to Overreaction, which is typically associated with the long term.

4. Since anchoring is often associated with framing, here is a simple example of how framing can work. I ask people how to pronounce the capitol of Kentucky, is it Lewisville, or Loueyville? I just framed the question. I hear an even amount of both from the audience. The correct answer is Frankfurt. This is particularly interesting when I’m doing this while in Kentucky.

5. Herding, disposition, confirmation bias, and representativeness can provide justification for Trend following. Information is not dispersed evenly across the investor universe, especially for illiquid assets or if the information has much uncertainty, which leads to underreaction. If investors are reluctant to take small losses, then momentum is improved by the disposition effect.

6. Herding leads to Trend analysis. And finally, Overconfidence can lead to ruin.

Bottom line: You can enter any of these tracks at just about any point and the results will be similar.

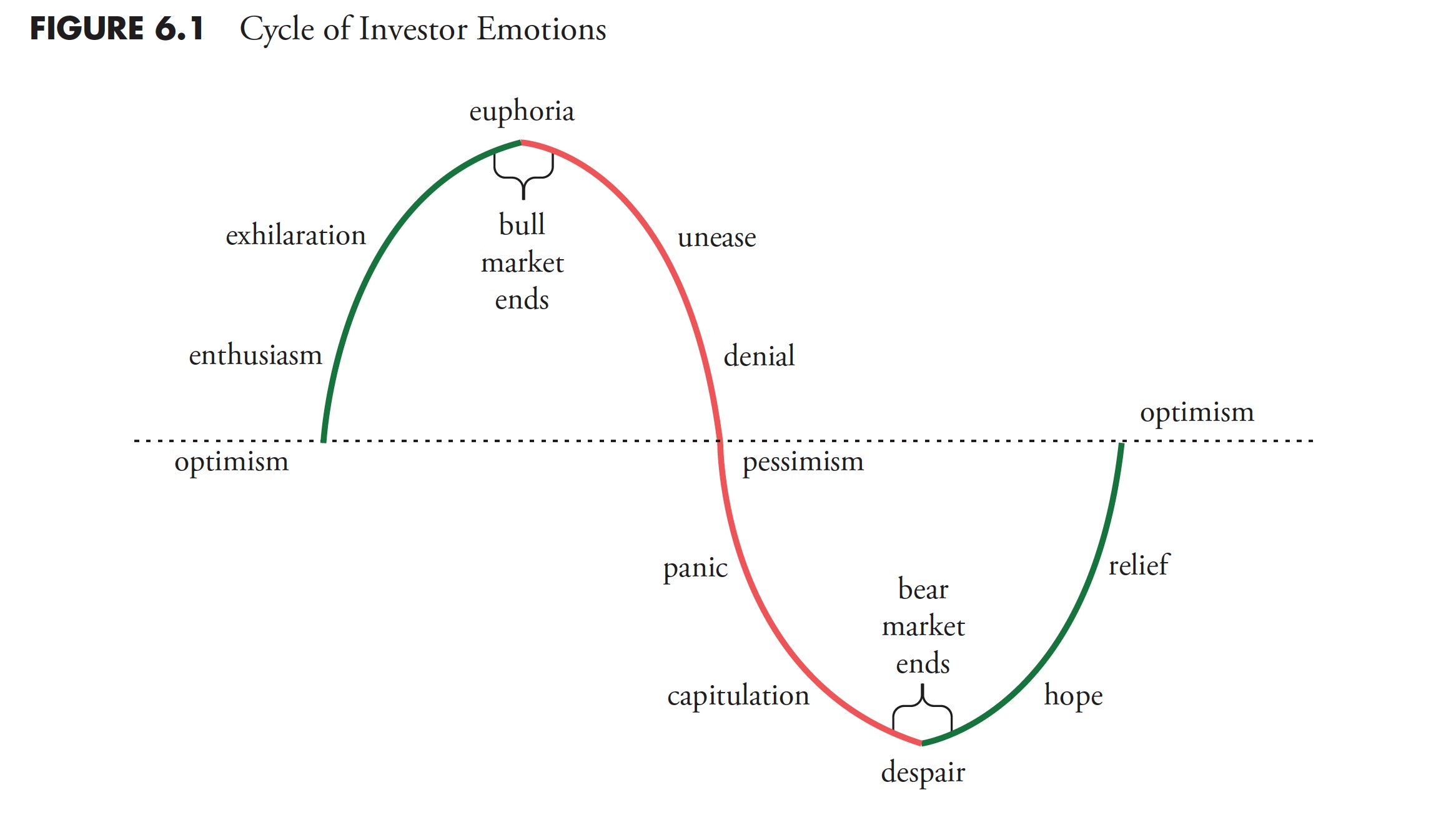

Investor Emotions

I would imagine that everyone has experienced the emotional cycle of investing without a plan. We buy a stock for whatever reason, primarily because we are optimistic about its future. When it does rise in price, it creates excitement, and as it keeps rising, a state of euphoria is dominating the investor’s mind. I can remember 30+ years ago thinking about quitting my day job during such a period. If the price then drops a bit, it immediately causes anxiety; if it drops more, then downright fear sets in. Even further price erosion leads to panic driving the investor, with the absolute depression being the last phase of investor disappointment, usually coinciding with finally selling the stock. However, if one is still frozen with depression and panic when the price then rises, hope is instilled. Rising prices slowly bring on optimism, and the emotional cycle of unplanned, random, guesswork like investor begins again. Figure 6.1 shows this emotional cycle.

Figure 6.1

Investors as a Whole Do Poorly

Data has shown that investors as a whole continue to buy and sell at exactly the wrong time. Although we cannot possibly know the specific reasons, a shallow understanding of the human psyche will offer some answers. They react to news without doing any analysis, and it doesn’t matter if it is considered good news or bad. Investors become mesmerized by long-running bull markets and absolutely unnerved by bear markets. They, as a whole, try to match the investment acumen of their relatives, neighbors, friends, business associates, and even complete strangers, if they have claimed, even casually, that they have done well in the market.

Table 6.1

There is a study put out annually by Dalbar, which shows that investors as a whole underperform the markets in a number of different ways. In fact, they have consistently underperformed the S&P 500 anywhere from 4 percent to 10 percent per year for the past 27 years as of 2012 (Dalbar began their service in 1984). The percentage might seem small at first glance, but, over time, it becomes significant. Significant in this example can mean that one may not recover from it. Table 6.1, using data from JP Morgan, shows the 20-year annualized returns for various asset classes and the average investor based on the Dalbar data.

Another study put out by Morningstar’s Russell Kinnel, on 2/4/2013, shows the same problem; investors as a whole do quite poorly compared to indices. (See Table 6.2.) Based on all funds, the average investor lagged the average fund by 0.95 percent annualized over the past 10 years.

Table 6.2

Buying and selling at the wrong time can be explained by the fact that most investors react to news, whether it is positive or negative, without any detailed analysis. They are mesmerized by seemingly unending uptrends in the market and demoralized by continuing new lows. The bottom line is that they fail to have the discipline to follow a systematic approach that will assist them on detaching their emotions from their decisions.

Here is a list of investor faults when it comes to investing. Books are filled with much more and with much more detail, I just wanted to include the ones that I have experienced, with the Lack of Discipline being the one that can cause the most pain.

Lack of discipline Impatience Greed Refusal to accept the truth No objectivity Impulse behavior Avoid false parallelsYour human brain will play tricks on you. If you take an escalator or moving sidewalk when going to work and do so frequently, you will understand. Your brain will cause an automatic (involuntary) action to assist you as you step onto the escalator or moving sidewalk. You might not even realize it. However, if one day the escalator is stopped, and you notice that it is stopped, you will almost stumble as you step onto it, because your brain is programmed to assist, and this time that assistance is not helpful, even though you knew it was not moving prior to stepping on it.

Many who are not good at math use heuristics or, worse yet, guessing to solve problems. I’ll just use a few of the math issues that James Montier has used over the years as examples.

Example A: You are told that a baseball and bat cost a total of $1.10, and that the bat cost $1 more than the ball. What is the cost of each? The solution involves a really simple eighth grade algebra problem, but most will just guess and their initial guess will probably be that the bat costs a $1 and the ball costs $0.10. Because those numbers just almost pop out at you from the information given. Unfortunately, they forgot the part of the problem that said the bat costs $1 more than the ball. Their usual answer has the difference being $0.90.

Let the ball = X, then we know that the bat is X+100 (using cents here), so the equation is:

X (ball) + (X + 100) (bat) = 110.

Simplifying, it becomes 2X + 100 = 110,

again, 2X = 110 – 100,

again, 2X= 10, or X = 5 = $0.05. Therefore the bat costs $1.05.

Example B: You are told that a swimming pool that measures 100 feet by 100 feet has a lily pad plant put into it. The plant doubles in size every day. If it completely covers the pool in 24 days, how long did it take to cover half of the pool? Most will quickly say 12 days, as the word double and 24 just seem to yearn for that. Of course, some will be really hesitant trying to invoke the size of the pool since that was given—it has absolutely nothing to do with the problem. The correct answer is 23 days. Think about it.

Example C: Your coffee shop is offering two deals on coffee: the first is 33 percent more coffee, and the second takes 33 percent off the price. Which would you choose? Most would claim they are essentially equal. A discount of 33 percent is the same as getting a 50 percent increase in the amount of coffee. Bottom line: Getting something extra for free feels better than getting the same for less. But, is it?

Most view these options as essentially the same proposition, but they’re not. The discount is by far the better deal because most don’t realize that a “50 percent increase in quantity is the same as a 33 percent discount in price.” But let’s do the math. The initial price is $10 for 10 ounces of coffee. Hopefully, it’s obvious that the unit price is therefore $1 per ounce. An extra 33 percent more “free” coffee would bring the total up to 13.3 ounces for $10. That $10 divided by 13.3 ounce gives us a unit price of $0.75 per ounce. With a 33 percent discount off the initial offer, though, the proposition becomes $6.67 for 10 ounces, for a unit price of $0.67 per ounce. After reading this, you will probably pay anything for a cup of coffee.

Now that I hopefully have captured your attention in the first six chapters, let’s focus on some facts about the market. The next chapter focuses on bull and bear markets, both cyclical and secular, along with many convincing statistics about them.

Thanks for reading this far. I intend to publish one article in this series every week. Can’t wait? The book is for sale here.