The S&P 500 gained 1.1% last week in a move that puts this Index at a record high. While this is exciting news for investors, those that owned some of last week’s top performers are in even better spirits, as the average gain for the top ten movers in this Index was 10.3%. Even more unusual was that almost three quarters of these names were from the same industry group.

The industry group I’m referring to is Semiconductors, which posted outsized gains after a positive earnings report from the world’s largest chip manufacturer, Taiwan Semiconductor (TSM), sparked a rally in these stocks. Prior to that, a bullish report for Advanced Micro (AMD)’s outlook put this stock on its path to posting almost 20% for the week. Subscribers to my MEM Edge Report will be familiar with this stock, as we highlighted AMD as a strong buy on Sunday and then again on Wednesday.

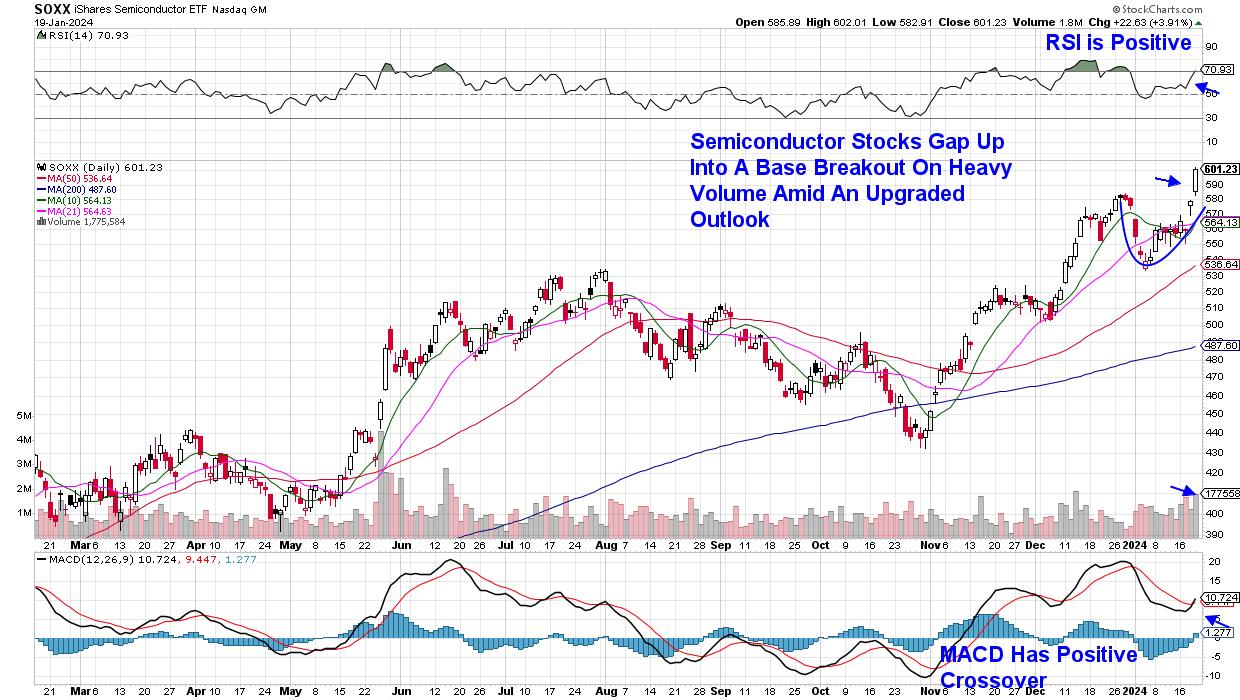

Daily Chart of iShares Semiconductor ETF (SOXX)

Software stocks also outperformed last week, with the names from this area that are on our Suggested Holdings List posting gains that keep them in confirmed uptrends; they’re poised to trade higher from here. If you’d like immediate access to this List, use this link here for a 4-week trial of my twice weekly report. In addition to recommending leadership stocks that often go on to outperform the broader markets, this report keeps you tuned into sector rotation, interest rate outlooks, and other big picture concepts that keep you on top of what’s moving the markets and, more importantly, what to look out for.

This Sunday’s MEM Edge Report will review additional events taking place in the markets that are unusual. Among them, Growth stocks are advancing, despite interest rates remaining relatively elevated, and while the S&P 500 is now at new highs, the Equal-Weighted S&P 500 has been languishing. Use the link above for insights into these and other counterintuitive activities shaping today’s market.

Warmly,

Mary Ellen McGonagle

MEM Investment Research