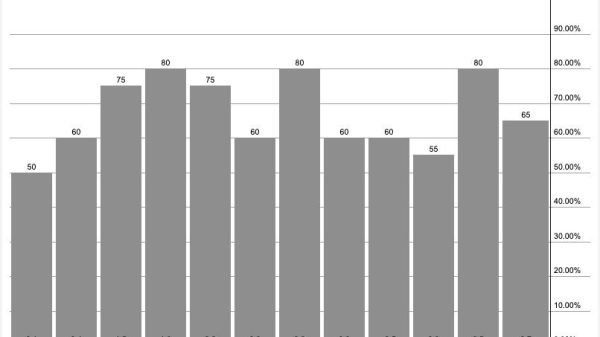

Oil and natural gas: Oil rises above the $80.00 level

After three months, the oil price was again above the $80.00 level yesterday. This week, we see a pullback in the price of natural gas from the $2.75 level.Oil chart analysis

After three months, the oil price was again above the $80.00 level yesterday. During the Asian trading session, the price of oil consolidated at the $79.50 level, gaining support and returning to the $80.00 level. Now, we could see a continuation of the bullish consolidation and new testing of the previous high at the $80.57 level. Potential higher targets are $81.00 and $81.50 levels.

We need a negative consolidation and a break below the support at the $79.50 level for a bearish option. After that, we could expect to see a continuation of the pullback and a test of the $78.50 previous support level. Potential lower targets are $78.00 and $77.50 levels.

Natural gas chart analysis

This week, we see a pullback in the price of natural gas from the $2.75 level. The price fell to $2.54 yesterday, forming a seven-day low. After that, during the Asian trading session, the price recovered and climbed to the $2.60 level. We are now consolidating below that level and looking for support at the $2.58 level. For a bullish option, we need a continuation of positive consolidation and a move above the $2.60 level. Potential higher targets are $2.62 and $2.64 levels.

We need a negative consolidation and a new pullback to the previous low at the $2.54 level for a bearish option. A break below would mean a continuation to the bearish side and the formation of a new low. Potential lower targets are $2.52 and $2.50 levels.

The post Oil and natural gas: Oil rises above the $80.00 level appeared first on FinanceBrokerage.