According to IoT Analytics, a leading global provider of market insights and strategic business intelligence for the Internet of Things (IoT), the eSIM/iSIM market is set to surpass 500 million units in 2023 as it brings in the new age of cellular IoT.

More information can be found in IoT Analytics’ new Global IoT eSIM Modules and iSIM Chipsets Market Tracker, which provides quarterly data on worldwide IoT eSIM modules and iSIM chipsets from 2018 to Q1 2023.

KEY QUOTES:

Satyajit Sinha, Principal Analyst at IoT Analytics, comments:

“Looking ahead, it’s evident that eSIMs are positioned to become the primary SIM technology in the next 2-3 years, surpassing their counterparts. This shift is expected to be followed by the emergence of iSIMs, which are predicted to gain popularity due to their advanced security features, including a hardware root of trust. We’ll likely see a gradual transition from eSIMs to iSIM technology, as iSIMs are expected to become the preferred choice in the long term due to their inherent security advantages.”

KEY INSIGHTS:

eSIM/iSIM is transforming the dynamics of the cellular IoT market, offering increased flexibility, reduced provisioning time, smaller form factor, enhanced security, and sustainability. The eSIM/iSIM IoT market is poised to surpass the 500-million-units mark in 2023. Two factors will likely drive the growth of eSIM and iSIM in the cellular industry: cybersecurity regulations and GSMA specifications.Entering the new age of cellular IoT: eSIM/iSIM market to surpass 500 million units in 2023

Market overview

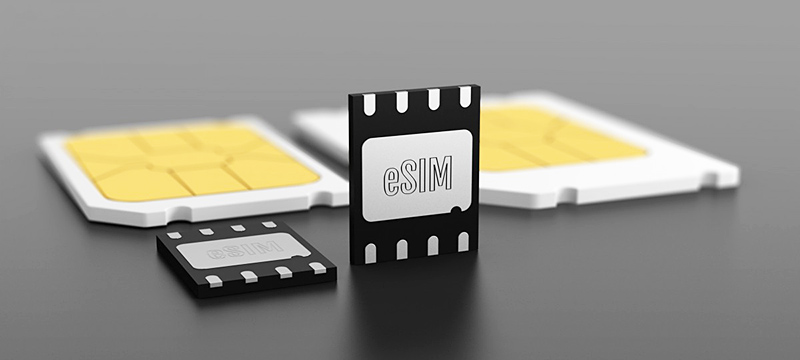

The cellular IoT market is undergoing a significant shift: physical subscriber identity module (SIM) cards as we know them are becoming virtualized in the form of embedded SIMs (eSIMs) or integrated SIMs (iSIMs).

In 2023, the IoT module eSIM/iSIM market is poised to surpass the 500-million-unit mark. Just in the first quarter, over 450 million IoT modules were already capable of supporting eSIM or iSIM—roughly 16% of the 2.8 billion active global cellular IoT connections. This data indicates the growing demand for flexible, fast, and efficient connectivity solutions in the new age of cellular IoT.

eSIM/iSIM is transforming the dynamics of the cellular IoT market

The rise of eSIM/iSIM technology is not just a mere technological advancement; it is a paradigm shift. It is about the seamless integration of IoT devices, the simplification of connectivity, and the enhancement of user experience. The use of eSIMs/iSIMs can help businesses decrease time to market and improve the efficiency of IoT deployments. This technology offers several advantages over traditional SIM cards, including:

1. Increased flexibility for IoT solutions

eSIM/iSIM technologies offer increased flexibility and reduced provisioning time for IoT devices. By allowing devices to be provisioned with different carrier profiles remotely, they enable seamless switching between networks without the need for physical SIM card changes. This flexibility is particularly beneficial for businesses deploying IoT devices in multiple countries or regions. Additionally, the ability to remotely provision and update eSIM/iSIM saves time and simplifies the deployment process, especially in large-scale IoT deployments, empowering businesses to adapt quickly and optimize their IoT deployments.

Several car companies, including BMW, Audi, Tesla, and Volkswagen, have implemented eSIM technology to offer connected car services. Through their respective platforms, these companies can remotely activate, manage, and switch mobile network profiles. This allows for more flexibility and scalability in IoT deployments.

2. Compact eSIM/iSIM enables smaller IoT devices

eSIM and iSIM technology allows for more compact IoT device designs. This makes devices smaller and more lightweight than traditional SIM-card-based devices. Notably, eSIM/iSIM technology has facilitated the development of smart labels, which are paper-thin devices that offer precise, accurate, and secure tracking of small and lightweight items.

DB Schenker, the logistics arm of Deutsche Bahn, implemented an ultra-thin smart-label solution to track small freight consignments globally. Sensos, an Israeli group company of the Sony Semiconductor Solutions Corporation, developed the solution, which leverages Kigen’s iSIM technology embedded within Sony Semiconductor Solutions’ low-power wide-area (LPWA) chipset.

3. Enhanced security with embedded secure elements in eSIM/iSIM

eSIM/iSIM technology incorporates embedded secure elements, providing advanced security features compared to traditional SIM cards. The secure element acts as a hardware root of trust for asymmetric encryption, ensuring secure end-to-end communication. The GSM Association’s (GSMA) IoT SAFE specifications leverage a single eSIM/iSIM as a hardware root of trust.

Meanwhile, chipset vendor Sony Semiconductor Israel’s ALT1250 and ALT1350 chipsets integrate two secure elements for application security and UICC identity (Sony Semiconductor Israel was formerly known as Altair Semiconductor and is now a group company of Sony Semiconductor Solutions Corporation).

The eSIM in Tesla vehicles enables features such as remote vehicle monitoring, software updates, and over-the-air (OTA) updates for the vehicle’s firmware. The eSIM acts as a hardware root of trust by securely storing cryptographic keys and certificates used for authentication and encryption.

4. Sustainable eSIM/iSIM technology reduces waste and emissions

eSIM/iSIM technology eliminates the need for physical SIM cards, reducing electronic and plastic waste. Additionally, the elimination of physical SIM card shipments to IoT modules or devices helps reduce emissions associated with transportation. These environmental benefits make eSIM/iSIM a sustainable choice for IoT connectivity.

Journey to 500 million: eSIM market penetration increased, iSIM is emerging, and GSMA streamlines deployment

Per IoT Analytics’ Global IoT eSIM Modules & iSIM Chipsets Tracker, eSIM penetration within cellular IoT modules experienced a significant increase, with quarterly shipments of eSIM-capable modules rising from 7% in Q1 2018 to 31% in Q1 2023. Notably, there was a period of stagnation in this growth during 2021; however, from Q1 2022 onward, we observed a consistent adoption rate through Q1 2023.

Meanwhile, iSIM is still an emerging technology in IoT. Sony Semiconductor Israel’s ALT1250 is the only iSIM-based cellular IoT chipset that reached mass shipments.

So far, the implementation of eSIM/iSIM IoT standards has been slower than initially anticipated. This is primarily due to the complexities of remote SIM provisioning and different standards for consumer IoT and machine-to-machine (M2M) technologies.

To address this issue, GSMA developed new eSIM IoT specifications, namely SGP.31 and SGP.32, that are designed to complement the existing M2M (GSMA SGP.02) and consumer IoT (GSMA SGP.22) eSIM standards. The new specifications allow for remote control and configuration of eSIMs via a dedicated management module, adapting from the current eSIM Consumer and IoT Specification.

This approach eliminates the need for user interaction when provisioning, simplifying IoT connectivity and reducing the time to market for IoT deployments. Moreover, this enhancement may eliminate the need for carrier integration, giving enterprises the same flexibility and control as consumers, thus marking a significant advancement for IoT implementations.

The release of GSMA SGP.31 and SGP.32 marked significant changes in eSIM IoT deployment in three ways:

Introducing the eSIM IoT Remote Manager (eIM) Transforming Local Profile Assistance (LPA) into IoT Profile Assistant (IPA) Replacing Subscription Manager Secure Routing (SM-SR) with Subscription Manager Discovery Server (SM-DS) and IPA in the architectureThese changes streamline both remote profile management and provisioning processes and eliminate the need for SM-SR in eSIM IoT deployments.

The future of eSIM/iSIM in cellular IoT

Looking ahead, we expect eSIM/iSIM technology to further increase its penetration in the cellular IoT market.

Currently, the market is still dominated by a combination of physical SIM cards, uSIM, and soft SIMs (software-based UICCs in a trusted execution environment), with a combined (shipment-based) market share of approximately 67%. (Note that Soft SIMs are not considered to be secure, as they lack an anchor with a hardware root of trust.)

As the industry progresses, we assess that eSIMs will become the dominant SIM technology in the next 2–3 years. Afterward, with the next cycle of module hardware, iSIMs are likely to start grabbing market share since they offer enhanced security features and are anchored with a hardware root of trust, making them a more secure option. In the long run, it is expected that even the eSIM market will migrate toward iSIM technology, with iSIM then dominating the market.

Two factors will likely drive the growth of eSIM and iSIM in the cellular industry:

1. Cybersecurity regulation

The importance of robust security measures in cellular IoT cannot be overstated. Cybersecurity regulations are playing a pivotal role in strengthening IoT security, particularly through the implementation of hardware-based solutions.

Given the recent activity around EU and US technology regulation, it is likely that the coming years will see new laws mandating stronger IoT security, potentially requiring the use of a hardware root of trust.

In this context, eSIM/iSIM technology emerges as a practical solution for implementing chip-to-cloud security. By leveraging the secure element as a hardware root of trust, it is possible to enable asymmetric encryption, thereby bolstering the overall security framework. It is noteworthy that cellular IoT vendors are already guided by GSMA’s IoT SAFE specifications, which provide valuable insights and guidelines in this area.

2. GSMA specifications

GSMA’s SGP.31 and SGP.32 will play a crucial role in the future of eSIM/iSIM in cellular IoT. By streamlining the remote profile management and provisioning processes, these specifications will simplify the deployment of IoT devices and reduce the time to market. Furthermore, the introduction of eSIM and the transformation of LPA into IPA will provide businesses with greater control over their IoT deployments, enabling them to adapt quickly to changing market conditions and customer needs.

The post eSIM/iSIM market to surpass 500 million units in 2023 appeared first on IoT Business News.