SPX Monitoring Purposes: Long SPX 6/21/23 at 4365.69; sold 7/21/23 4536.34=gain 3.91%.

Long SPX on 2/6/23 at 4110.98: Sold 6/16/23 at 4409.59 = gain of 7.26%. Gain since 12/20/22=17.68%.

Monitoring Purposes GOLD: Long GDX on 10/9/20 at 40.78.

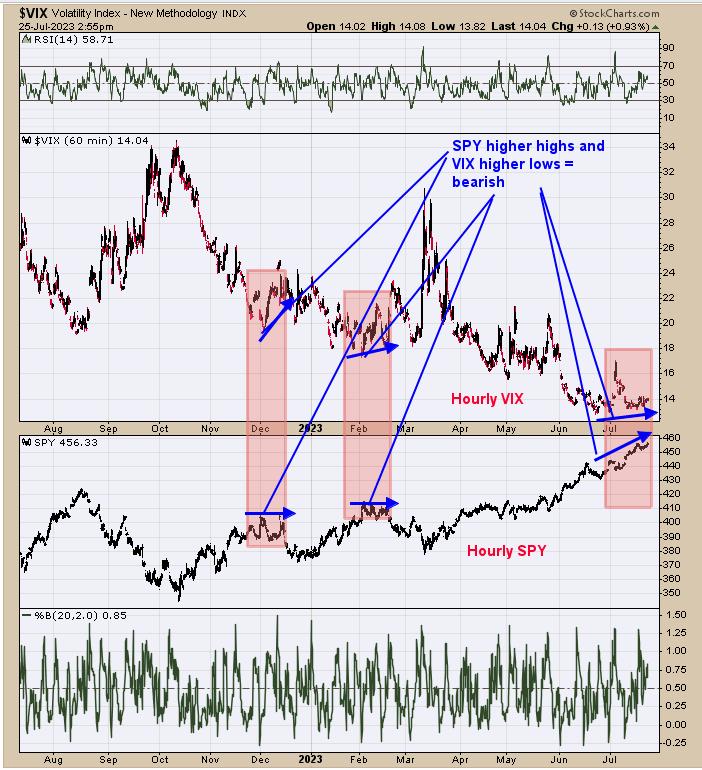

The second window up from the bottom is the hourly SPY, and the next higher window is the hourly VIX. Bearish signs form when the SPY makes higher highs and the VIX makes higher lows. We noted those times shaded in pink. The current bearish sign started in late June and is ongoing so far. The FOMC meeting announcement is scheduled for tomorrow around 2:00 Eastern, and it looks as though there will be a ¼% increase. With the VIX rising along with the SPY, a reaction in the market is possible.

We updated this chart from yesterday and what we said yesterday still stands. “The bottom window is the 10-day average of the TRIN; the next higher window is the 21-day average and the next window higher is the 63-day average. All three moving averages of the TRIN reached bearish levels in late June-early July. These signals can occur before a top in the market forms. We use this type of indicator to warn us that a pullback may be coming. The market appears to becoming a little exuberant, which in turn may stall the rally. We sold our long position on Friday and are waiting for the next setup. In general, the market looks more sideways over the next few weeks, rather than seeing a big pullback.”

The bottom window is the 18-day average for the advance/decline percent for GDX, and the next higher window is the 18-day average for the up down volume percent for GDX. In a nutshell, when both indicators are above -10 (noted in blue), GDX is in an uptrend. Current readings stand at +25.20 (bottom window) and +24.54 (next higher window). When both indicators fall below -10, that is when GDX may start to consolidate. As for now, GDX is in the bullish mode.

Tim Ord,

Editor

www.ord-oracle.com. Book release “The Secret Science of Price and Volume” by Timothy Ord, buy at www.Amazon.com.

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. Opinions are based on historical research and data believed reliable; there is no guarantee results will be profitable. Not responsible for errors or omissions. I may invest in the vehicles mentioned above.