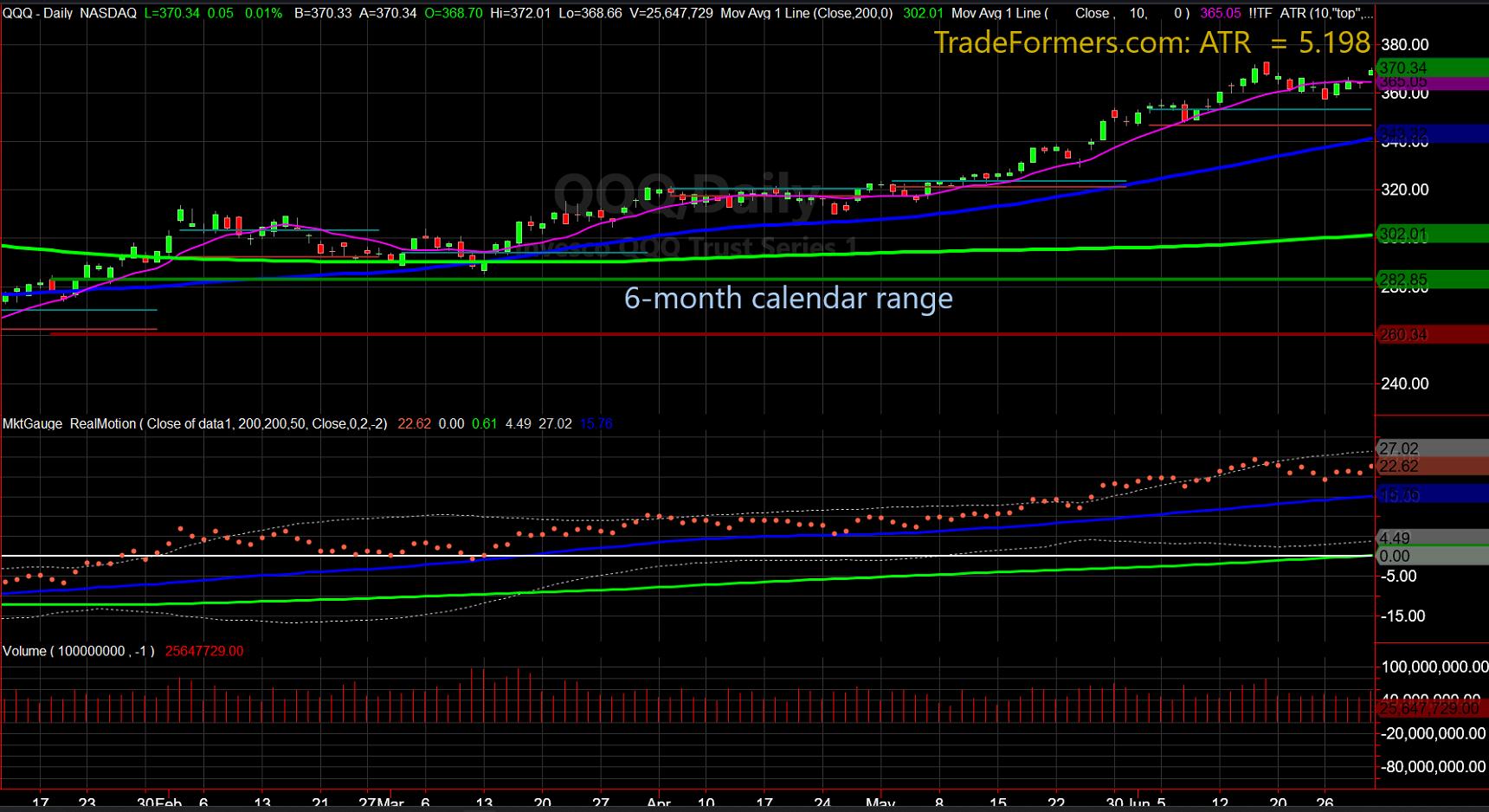

One of the most interesting things about July in the market is the biannual reset of the 6-month calendar range. Above is a chart of the NASDAQ 100, with the January 6-month calendar range drawn in. (To clarify, it is the solid green line that goes perfectly horizontal across the screen.)

The lower chart is the Real Motion momentum indicator. The bottom is the daily volume.

Since the beginning of 2023, QQQ cleared the 6-month calendar range high and never looked back. We had a brief test in March, but no violation. As we are about to reset that range, note the momentum. QQQs are working off a mean reversion from early June.

The current momentum, considering how close QQQs are to the recent highs made June 16th, is not bad, but meh. The volume pattern in July thus far is also meh. So, we do not know yet how much more upside versus downside the large-cap growth stocks have yet.

What we do know, though, is that the NASDAQ looks one way, while the small caps look completely different.

In January, IWM cleared its 6-month calendar range high. Then, in March, IWM failed those highs. Since then, IWM has not been able to get back above the calendar range high on a closing basis.

The Real Motion momentum indicator is also mainly meh, but holding. And, looking at volume, IWM has had only 1 accumulation (June 29th), on an up day since June 26th.

While NASDAQ did not look back once that calendar range high cleared, small caps, to date, refuse to clear. Nonetheless, with the reset, we are open for anything. Our guess is that if IWM can clear the calendar range, we’ve got ourselves at least a leg higher and perhaps more. We imagine this would give value stocks a boost. However, should IWM fail to clear the calendar range high and worse, break down under a new 6-month calendar range low (the thick red horizontal line), it would be hard to think NASDAQ can sustain current levels.

Either way, the range will reset in less than 2 weeks.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish reviews her first-quarter trades in this appearance on Business First AM.

Mish talks women in the trading space and covers a wide variety of ideas in this interview for FreeFX.

Mish runs through bonds, modern family, commodities ahead of PCE on Benzinga.

Mish explains her bullish call on Bitcoin and provides her price target for the cryptocurrency in this video appearance on CNBC Asia.

Mish shares why the transportation ETF is such an important measure of economic strength and how retail stocks (XRT) continue to underwhelm on the Tuesday, June 27 edition of StockCharts TV’s The Final Bar with David Keller.

Mish discusses how business have been watching Russia in this appearance on Business First AM.

Read Mish’s commentary on how the situation in Russia impacts the markets in this article from Kitco.

Watch Mish’s 45-minute coaching session for MarketGauge’s comprehensive product for discretionary traders, the Complete Trader.

On the Friday, June 23 edition of StockCharts TV’s Your Daily Five, Mish covers a variety of stocks and ETFs, with eyes on the retail sector for best clues in market direction.

Read Mish’s interview with CMC Markets for “Tricks of the Trade: Interviews with World-Class Traders” here!

Mish delves into the potential next market moves for several key markets, including USD/JPY, Gold and West Texas crude oil in this appearance on CMC Markets.

Mish and Dale Pinkert cover the macro, the geopolitical backdrop, commodities, and stocks to watch on FACE Live Market Analysis and Interviews.

Mish and Ashley discuss buying raw materials and keeping an eye on Biotech on Fox Business’s Making Money with Charles Payne.

Coming Up:

June 29: Twitter Spaces with Wolf Financial (12pm ET) & CNBC Asia (9pm ET)

June 30: Benzinga Pre-Market Prep

July 6: Yahoo Finance

July 7: TD Ameritrade

July 12: Real Vision

ETF Summary

S&P 500 (SPY): Needs one more push or begins to look a bit toppy based on lethargic momentum. Russell 2000 (IWM): 190-193 still the overhead resistance to clear. Dow (DIA): 34,000 support to hold. Nasdaq (QQQ): Still working off a reversal top until it takes out 372.85. Regional banks (KRE): Need a new move over 42. Semiconductors (SMH): 150 support. Transportation (IYT): 250 pivotal and a potential correction /mean reversion in store. Biotechnology (IBB): 121-135 range. Retail (XRT): 63 support.Mish Schneider

MarketGauge.com

Director of Trading Research and Education