Have you noticed how every roadblock the bears use against the bulls just quietly goes away over time? I just chuckle. There have been SO many bullish signals over the past year, but pessimists/bears don’t give in easily and that’s actually good for the stock market as the non-believers help to fuel the market higher. Looking back over the past year, I’ve heard the bears lay out so many reasons why the stock market recovery would fail. Here’s a starter list:

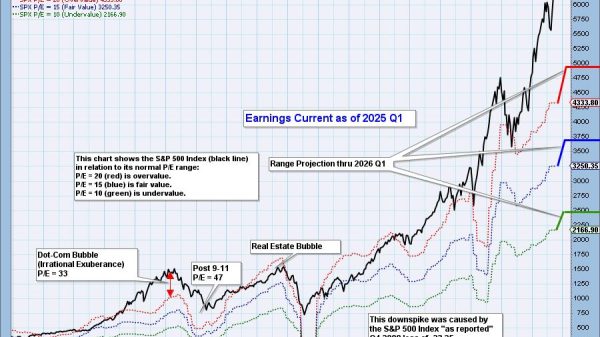

Inflation will run rampant Higher interest rates will thwart the economy The pace of rate hikes is too much The daily charts are bearish The weekly charts are bearish The monthly charts are bearish The (fill in the blank) charts are bearish Don’t fight the Fed Growth stocks aren’t participating (Q4 2022) The 2023 rally is too narrow, breadth stinks PE ratios are too high It’s short covering Small caps aren’t participating Transports aren’t participating A major recession is coming There’s an inverted yield curve Go away in May The VIX is too low and my personal favorite, We’re in a bubble!Am I wrong? Haven’t you seen every one of these in the bearish “click bait” headlines in the media? That last one is a “last gasp” attempt to will the market lower. We rarely have true bubbles that desperately need deflating. This ain’t one of them. Most cries about a bubble result from those who have missed a big rally. Rather than admit defeat and that their bearish thoughts and strategies are wrong, they double down and call the rally a bubble. After all, if they thought prices were too high eight months ago, of course they’re going to think prices are WAY too high 30% or 40% or 50% later. Since June 2022, however, my signals have told me ONE thing consistently. We’re going higher. And higher and higher we’ve gone. While the S&P 500 is up nearly 29% since October 13, 2022, the NASDAQ 100 ($NDX) is up over 45%! Go ahead, call it a bear market rally, if you’d like. I know better.

One thing I’ve learned from studying history is that when a bear market ends, the biggest gains are enjoyed during the first year of the new bull market advance and that’s the gain that most bears miss. They can’t see it coming and use all of the excuses shown above to argue their erroneous position.

Let’s take a trip down memory lane, shall we?

We’ve had 14 bear markets on the S&P 500 since 1950 and 7 of them (50%) have ended during the month of October. The S&P 500 low was touched in October 2022, October 13th to be exact. Since that day, the S&P 500 has risen 998.40 points, or 28.92%. Among the prior 10 cyclical bear markets, the average ensuing 1-year return from the cyclical bear market bottom has been 41.74%. If we simply see a 1-year rebound that equals the average of the prior 10, the S&P 500 would be projected to be 4892.84 on October 13, 2023. Currently, the all-time high stands at 4818.62 and we’re well on our way to eclipsing it in 2023.

The following is an Excel spreadsheet that highlights prior secular and cyclical bear markets, and their 1-year, 2-year, and 5-year recoveries from the bear market low:

I’ve separated cyclical bear markets and secular bear markets, so that you can see how the S&P has reacted to each over the past 73 years (since 1950). Those columns that are blank mean that not enough time has elapsed since the respective bear market bottom ended to calculate returns for the periods indicated. Given that the 2022 cyclical bear market was roughly “average” compared to all cyclical bear markets, perhaps we should be expecting a similar 1-year and 2-year rebound. That would imply an S&P 500 close of 4892.84 on October 13, 2023 and 5423.90 on October 13, 2024. To argue these numbers, you’re fighting history.

Understanding history, and profiting from it, is super important in becoming and remaining a successful investor/trader. Many times, it’s honestly nothing more than maintaining a healthy dose of perspective. On Thursday, July 6th, at 7pm ET, I’ll be hosting our next “Bulls-Eye Forecast: Mid-Year Update” event. No one has forecast the S&P 500’s future direction better than we have at EarningsBeats.com. I want you to join me. First, let me say that it’s FREE. Second, I’ll repeat that – it’s FREE!!!! Is that not enough incentive? Ok, well let me sweeten the offer. When you sign up for this event, I’ll send you a bonus “Money Flows” pdf report that you can immediately download. There’s tremendous historical information that’s included and that EVERY single trader should be aware of. Register for the BIGGEST EVENT OF 2023 and receive your FREE “Money Flows” report by CLICKING HERE. Register NOW as seating is limited!

Happy trading!

Tom