On June 12th, Goldman Sachs (GS) came out stating how bearish they are on oil. I wrote a Daily about it on June 20th.

It’s not uncommon for me to stick my neck out and go against the big analysts. Heck, I have made a career out of looking at the economy and the market differently. Plus, those who know me know that I often make bold calls. However, not so fast on bragging rights just yet.

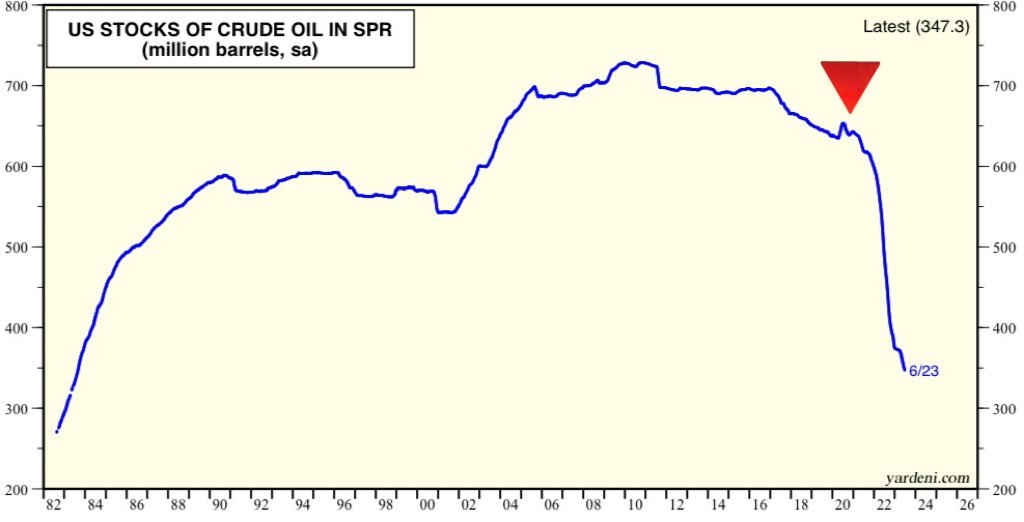

Nonetheless, with oil inventories hitting the tape today, it does make one wonder what planet these analysts live on? I guess the one where the government did not drain reserves to lower costs and then neglected to replace those reserves.

We live on the planet that this chart shows quite clearly, an alarming drop in reserves after a huge government drain. The lowest amount of oil in reserves since 1983. Plus, the analysts talk about a lack of demand, just as airline stocks are flying along with the Transportation Sector — as we discussed in another Daily featured this week.

First off, note June 12th. THE LOW (so far).

Note June 20th. A rally into resistance (so far).

Hence, not bragging rights at this point.

Move to today’s price action and we see some resistance to clear over 63.00.

The Leadership Indicator is very interesting. The blue line as measured by the benchmark or red line, looks like potential change in leadership. Should oil begin to outperform the S&P 500, not only will the Fed get concerned, but so should the deflationists.

Real Motion, or the momentum, is even more interesting. The 50 (blue) sits atop the 200-DMA (green). Momentum is gaining and could easily go back to a bullish divergence, just like it did briefly after June 20th. Momentum fell though since, so again, no bragging yet.

Last night’s Daily was about the Energy sector.

Maybe it’s nothing. Or then again, at the very least, it is worth watching… especially ahead of a holiday weekend.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish shares why the transportation ETF is such an important measure of economic strength and how retail stocks (XRT) continue to underwhelm on the Tuesday, June 27 edition of StockCharts TV’s The Final Bar with David Keller.

Mish discusses how business have been watching Russia in this appearance on Business First AM.

Read Mish’s commentary on how the situation in Russia impacts the markets in this article from Kitco.

Watch Mish’s 45-minute coaching session for MarketGauge’s comprehensive product for discretionary traders, the Complete Trader.

On the Friday, June 23 edition of StockCharts TV’s Your Daily Five, Mish covers a variety of stocks and ETFs, with eyes on the retail sector for best clues in market direction.

Read Mish’s interview with CMC Markets for “Tricks of the Trade: Interviews with World-Class Traders” here!

Mish delves into the potential next market moves for several key markets, including USD/JPY, Gold and West Texas crude oil in this appearance on CMC Markets.

Mish and Dale Pinkert cover the macro, the geopolitical backdrop, commodities, and stocks to watch on FACE Live Market Analysis and Interviews.

Mish and Ashley discuss buying raw materials and keeping an eye on Biotech on Fox Business’s Making Money with Charles Payne.

Coming Up:

June 29: Twitter Spaces with Wolf Financial (12pm ET) & CNBC Asia (9pm ET)

June 30: Benzinga Pre-Market Prep

July 6: Yahoo Finance

July 7: TD Ameritrade

ETF Summary

S&P 500 (SPY): 430-437 tight range. Russell 2000 (IWM): 180 held; can we get back over 185? Dow (DIA): 33,500 the 23-month MA now back above. Nasdaq (QQQ): 360 support and an inside week. Regional Banks (KRE): Back over 40, so now we need a new move over 42. Semiconductors (SMH): 150 back to pivotal. Transportation (IYT): New yearly highs; think impact on oil Biotechnology (IBB): 121-135 range. Retail (XRT): 63 pivotal.Mish Schneider

MarketGauge.com

Director of Trading Research and Education