Last week, we asked, “Can the Retail ETF XRT hold here?”

We wrote that the Consumer Sector ETF had some words for you. To summarize:

The test of the 80-month MA (green and price 56.24) on the last day of the month of May is mad interesting. Do not assume it will fail until it does. And even if it fails that MA, June has 30 days before we can determine what happens the second half of the year. XRT could just as easily hold that level, offering a very low risk/reward trade or, more importantly, a relief for the rest of the Economic Modern Family and market.So here we are in June. Granny XRT burned those that assumed she would fail.

The 6-to-8-year business cycle low as measured by the 80-month moving average held. Many retail and value names did indeed present traders with a low-risk entry AND relief for the Economic Modern Family. If you are still in the camp of not believing charts are useful, well, you’re probably not reading this Daily. Or you are reading this and remain on the fence about the validity of technical analysis.

Even the biggest skeptics must admit that this clutch hold of the 80-month moving average is impressive, and an important lesson for trading decisions. The market got a pass for now. Yay.

What’s Next on the Wall of Worry?

Granny Retail has more work to do to prove she is back in the game. On the monthly chart, 60.00 is a good place to watch for XRT to clear or not.

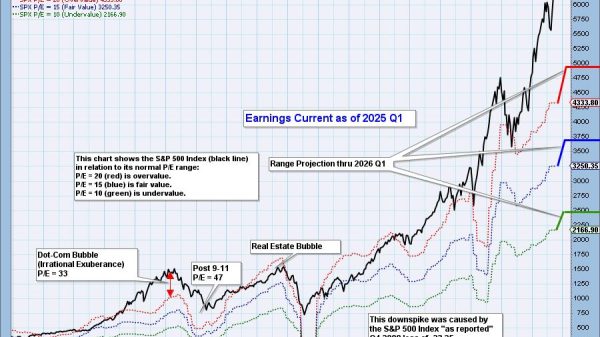

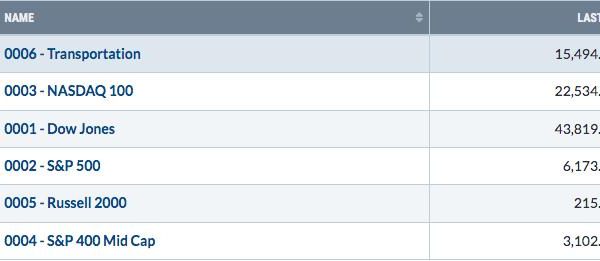

Looking ahead elsewhere, we have explored the idea that NASDAQ 100 can make it to 3800. We’ve also noted that SPX can make it to 4400 and the Russell 2000 can make it to 1950. But that would be a top because…

Inflation Will Come Back for a Second Round; Here’s Why

The debt ceiling passing could be inflationary as the overall debt is larger, while government spending continues. The dollar is strong, but BRICS grows stronger. China’s demands for goods also grows stronger. OPEC+ meets this weekend, while oil prices also held key support and are now rising.

The FED could “skip” or pause in June while yields are falling on their own. Let’s not forget that the regional bank crisis was averted with monetary loosening. Precious metals remain relatively strong, as they are above the 23-month MA or in an expanded 2-year business cycle.

Mother Nature wreaks havoc, as the latest news is the Panama Canal’s waterways are so low that ships are carrying less weight and the cost to ship goods is rising. On that note, hurricane season has begun.

Russia is once again threatening to pull back on Ukrainian exports of agriculturals.

The Point is This

In our prediction of stagflation, this rally in equities is not unexpected. The market will test the top of the trading ranges. Nonetheless, we do not expect deflation, as so many analysts have mentioned. We expect that the 25% decline in the CRB will reverse course as demand rises, while supply chain issues have not fully resolved.

Regardless, what a fun ride and a very interesting year. Stay tuned.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

With Congress having reached a deal after months of debt ceiling talks, what direction could the US dollar move in, and what could this mean for the USD/JPY? Mish explores the market movements in this appearance on CMC Markets.

Mish joins Rajeev Suri of Orios Venture partners to discuss the trend toward a risk-on situation in this video on LinkedIn.

Mish weighs in on the overnight slump across the board on the benchmarks and where the momentum is heading on Singapore Breakfast, available on Spotify.

Mish explains how reversal patterns could come to the fore this week in this appearance on CMC Markets.

Mish joins Rajeev Suri of Orios Venture partners to discuss the possibility of economic stagflation in this video on LinkedIn.

Mish discusses how AI is being used to invest in this article for BNN Bloomberg.

Mish joins Rajeev Suri of Orios Venture Partners to discuss the implications of the debt ceiling deal in this video on LinkedIn.

Mish discusses the commodities to watch in this video from CMC Markets.

In this appearance on Business First AM, Mish covers business cycles, plus where to go for trades once the dust settles.

Mish and Caroline discuss profits and risks in a time where certain sectors are attractive investments on TD Ameritrade.

Powell eyes a pause, Yellen hints at the need for more rate hikes, and debt ceiling talks face challenges… what a way to end the week, as Mish discusses on Real Vision’s Daily Briefing for May 19th.

Mish walks you through the fundamentals and technical analysis legitimizing a meme stock on Business First AM.

Coming Up:

June 5: Business First AM

June 6: CMC Markets and Wolf Financial Spaces

June 8: Wolf Financial Spaces

June 22: Forex Premarket Show with Dale Pinkert

June 23: Your Daily Five on StockCharts TV

ETF Summary

S&P 500 (SPY): August 2022 high 431.73, and of course 420 now key. Russell 2000 (IWM): Cleared 180; now must hold while still miles from its 23-month MA 193. Dow (DIA): Back above its 23-month MA, making 337 pivotal. Nasdaq (QQQ): 370 resistance, 350 now closest support. Regional Banks (KRE): Right up to that 42.00 critical level. Semiconductors (SMH): Closed Fri red. Reversal pattern top; a drop near 138-140 would be a decent correction. Transportation (IYT): Highest weekly close since early March-good sign if holds 230 level. Biotechnology (IBB): 121-135 range. Retail (XRT): 60 key now as is 56.25.Mish Schneider

MarketGauge.com

Director of Trading Research and Education