Stock Market Predictions 2023: Analyzing Opportunities

Are you eager to navigate the twists and turns of the stock market and make informed investment decisions? Look no further than the Singapore Stock Exchange and the enticing realm of Chinese equities. As investors eagerly await the next market move, the world of finance has become increasingly captivated by the potential of these dynamic markets.

We will explore the fascinating world of stock market predictions, focusing specifically on the latest updates from the Singapore Stock Exchange and the performance of Chinese equities. Buckle up as we dive into a wealth of valuable insights and market trends that are set to shape the investment landscape.

The Singapore Stock Exchange, a renowned global financial hub, has been steadily attracting attention from investors around the world. Its strategic location, robust regulatory framework, and diverse array of listed companies make it an enticing destination for both local and international investors seeking to tap into the Asian market.

Meanwhile, Chinese equities have become a force to be reckoned with as China’s economy continues to exhibit impressive growth and resilience. From technology giants to innovative startups, the Chinese stock market offers a plethora of investment opportunities that are catching the eye of astute investors.

Intrigued by the prospects of these markets? Stay tuned as we delve into the latest developments, predictions, and key insights surrounding the Singapore Stock Exchange and Chinese equities. Get ready to unlock the secrets of successful investing in these exciting domains.

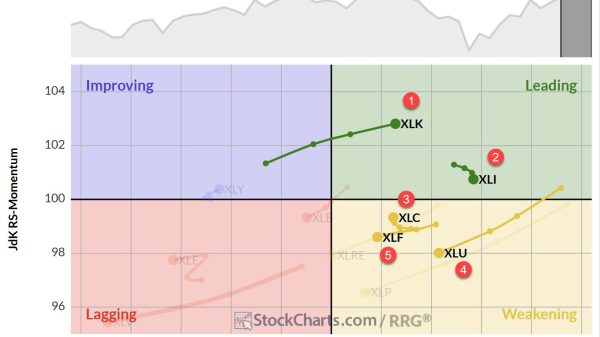

Assessing Market Trends and Future Outlook

The year 2023 has been marked by significant shifts in the global stock market. Market analysts closely monitor various indicators, seeking patterns that could shape stock market predictions. Factors such as interest rates and macroeconomic trends play a pivotal role in driving market movements. It is crucial for investors to stay informed and consider these variables when developing investment strategies.

One area that has attracted considerable attention is the stock market flotation trend. Flotation refers to the process of a private company becoming a publicly traded entity. As companies go public, investors gain the opportunity to participate in their growth and success. The Asian market, particularly the Singapore stock exchange, has witnessed a surge in new IPOs, presenting an array; as a result, Chinese equities are losing favor among bullish strategists. Citigroup Inc. and Jefferies Financial Group Inc. have both scaled back their ratings on China, citing concerns over geopolitics and the broader economic recovery. The recent decline in Meituan’s stock price, coupled with a mixed performance among other tech giants like NetEase Inc. and Baidu Inc., highlights the prevailing uncertainty.

Investors are eagerly awaiting positive developments in geopolitics and a stronger economic recovery before returning to the market in a meaningful way. Until then, the Singapore Stock Exchange and Chinese equities are likely to face an uphill battle, requiring significant catalysts such as monetary easing or a thaw in US tensions to reignite growth prospects.

The Influence of Chinese Equities

Chinese equities continue to be a significant focal point in stock market predictions for 2023. China’s economic prowess and increasing global influence have made its stock market an attractive destination for investors. However, it is important to navigate this market with caution, considering the inherent risks and uncertainties.

As the world’s second-largest economy, China’s stock market movements hold the potential to impact global financial markets. Investors keen on capitalizing on this market should carefully analyze the nuances and intricacies of investing in Chinese equities. Thorough research and a long-term perspective are crucial for mitigating risks while pursuing potential rewards.

The Singapore Stock Exchange and Chinese equities face a challenging road ahead as their post-Covid recovery loses momentum, leaving investors searching for catalysts to spark a rebound. The grim milestone of erasing half of the gains seen during a three-month reopening rally through January looms over the market. With frictions between China and the US on various issues dampening sentiment, confidence remains subdued.

Unveiling the Power of Stock Market Predictions in 2023

Accurate and informed stock market predictions are invaluable tools for investors seeking to make sound financial decisions. As we explore the prospects of 2023, it is essential to consider the potential offered by stock market flotation, especially on the thriving Singapore stock exchange. China’s onshore CSI 300 Index experienced a decline of up to 0.8%, adding to the woes it faced last week when it erased all the gains it had achieved in 2023. The decline can be attributed to a weaker yuan and concerns surrounding debt issues among developers. In contrast, the MSCI Asia Pacific Index, which tracks regional stocks, saw a positive shift as investor sentiment improved. This was driven by a recent agreement reached between President Joe Biden and House Speaker Kevin McCarthy regarding the US debt ceiling.

Additionally, the influence of Chinese equities cannot be overlooked, given their significance in global financial markets. By staying informed, employing comprehensive research, and maintaining a diversified investment portfolio, investors can position themselves strategically for success in the dynamic world of stocks.

The post Stock Market Predictions 2023: Analyzing Opportunities appeared first on FinanceBrokerage.