Arizona Senate candidate Rep. Ruben Gallego twice voted to protect a Biden Administration rule allowing pension fund managers to use so-called environmental, social and governance (ESG) factors when choosing investments for workers’ retirement plans, which some lawmakers have likened to ‘woke’ banking practices focusing on left-wing agendas.

Gallego’s move, in turn, also guarded a close friend and donor’s company in which he’s invested. In 2019, the Arizona Democrat reported attaining up to $50,000 in non-public stock in Aspiration Fund Adviser LLC, a financial technology company that partners with FDIC-member banks.

Gallego, however, had failed to divulge the purchase in his financial disclosure report until 2022 despite Congressional members having to declare assets valued at more than $1,000.

Aspiration was founded in 2013 as a ‘digital bank for environmentally conscious consumers’ but has since concentrated on selling carbon credits, according to Forbes. It’s also one of only a few financial technology companies ‘fully embracing the booming movement around environmental, social and governance (ESG) investing,’ the publication wrote in 2021.

Aspiration disclosed that nearly 70 percent of its revenue comes from ESG services in a Securities and Exchange Commission filing from that same year.

The company was co-founded and is co-owned by Joe Sanberg, Gallego’s longtime friend and donor. The pair attended Harvard together, and Gallego took part in Sanberg’s 2021 wedding in Puerto Rico, social media posts show. Sanberg has provided more than $20,000 to Gallego’s campaigns and leadership PAC since 2014, according to a search of federal filings.

Gallego first revealed banking with Aspiration in 2017. His most recent financial disclosure shows he owns shares in the Aspiration Redwood Fund — a ‘100% fossil fuel-free ESG fund’ with reportedly ‘high fees and lackluster performance’ — and the non-publicly traded shares in Aspiration Fund Adviser LLC.

Since 2017, Gallego has garnered as much as $12,200 in income from his Aspiration holdings, according to his financial disclosure forms.

‘This was a Republican messaging bill passed with Republican votes,’ Gallego’s communications director Jacques Petit told Fox News Digital on his two votes against H.J. Res. 30, which would have blocked a Labor Department rule allowing employers to consider ESG factors when choosing investments for workers’ retirement plans.

The joint resolution, however, did receive bipartisan support. Democratic Maine Rep. Jared Golden backed it in the House of Representatives, while Democratic Montana Sen. Jon Tester and Democratic West Virginia Sen. Joe Manchin backed it in the Senate.

He did not specifically address Gallego’s investments or his relationship with Sanberg. Instead, he said the information in the inquiry was ‘grasping at straws.’

Aspiration also operates the Aspiration Impact Foundation, a nonprofit that has funneled cash to far-left endeavors. The nonprofit has given $1,000 to the Trevor Project for climate change initiatives, its tax forms show. The Trevor Project also advocates for ‘using proper trans terms,’ believes gender is a social construct and published a manual on being an ally to transgender and young nonbinary individuals.

Additionally, the foundation provided a $5,000 grant to climate activist group 350 New Orleans, whose parent group has called for a ban on all new oil and gas projects and seeks to ‘defund’ fossil fuel companies.

The Biden administration has indicated that ESG is a top priority. Last November, the Department of Labor unveiled a rule that went into effect on Jan. 30 that allows managers to factor environmental and social issues into investment decisions for the retirement funds of more than 152 million Americans.

Gallego first voted against the resolution targeting the rule on Feb. 28. Nearly a month later, on March 20, Biden vetoed the bill. Days after the veto, on March 23, Gallego voted against overturning Biden’s veto when the effort to override the veto had failed.

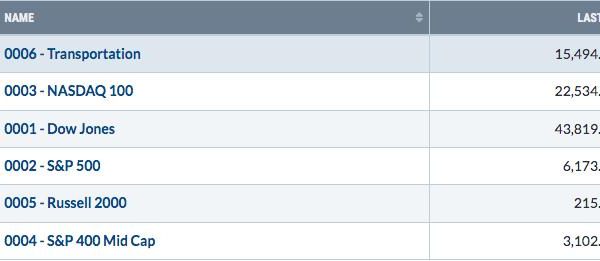

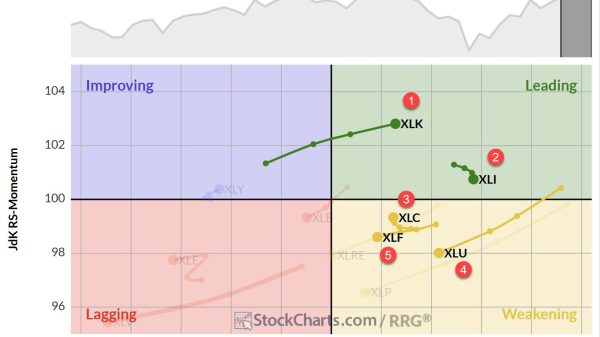

A UCLA and NYU study from earlier this year discovered that over the last five years, ESG funds underperformed compared to the broader market at an average of 6.3% to 8.9%.

Republicans have since targeted ESG banking. In late April, Republican Arizona Rep. Andy Barr announced he’d roll out legislation prohibiting banks from denying fair access to financial services under the standards of ‘woke corporate cancel culture,’ preventing financial institutions from being weaponized for political purposes.

‘Banks should make lending decisions relying on objective, risk-based metrics, not the standards of woke corporate cancel culture,’ Barr previously told Fox News Digital.

‘My legislation codifies the Fair Access Rule to ensure that Radical environmentalists, gun control advocates, crypto antagonists and other political activists cannot weaponize financial institutions in their fight to achieve their political agenda,’ he said.

Fox News Digital’s Brooke Singman contributed reporting.