US stocks have been in consolidation mode lately. By lately, one should think of several months, as, for instance, the Dow Jones trades around the same levels as it did in November 2022.

Plenty of things happened in the last five months, yet stocks do nothing. As it turns out, investors, especially retail ones, are worried and pessimistic about US stocks. After all, if a recession is imminent, why buy stocks? Also, with high interest rates, why risk and invest in the stock market?

The truth is that there is always something to worry about. The latest thing keeping investors away from the stock market is the debt ceiling and the possibility of a US default less than three weeks away.

According to Jenet Yellen, the US Treasury Secretary, a failure to raise the debt ceiling on time would be catastrophic. Also, Jerome Powell, the Fed’s Chair, used similar words at the latest FOMC press conference.

So, with the United States only three weeks away from a possible default, should you buy or sell US stocks?

The debt ceiling was always increased in the end

Investors have all the reasons to worry. History tells us that in 2011, when the debt ceiling was eventually lifted after intense negotiations, the stock market registered one of the most volatile weeks in history. For instance, the S&P 500 fell 19% in just three weeks.

But history also tells us that the debt ceiling has always been raised in time. More precisely, it was raised 89 times in the past under both a Republican and a Democratic Congress. Hence, the chances are that a default would be avoided again, as was the case so many times.

Stocks are not in such a bad shape

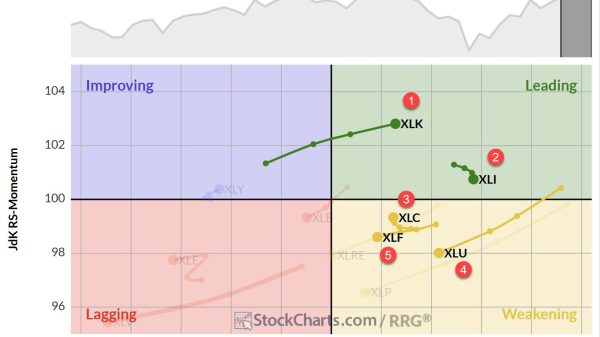

Market participants have heard lately that only a few stocks keep the market up. Unfortunately, that is far from the truth.

In fact, a diverse number of companies from different industries and sectors are less than 5% from a new 52-weeks high.

Therefore, if anything, buyers keep investing and believe that the debt ceiling fears are temporary. The US will deliver, as it did so many times in the past.

The post 3 weeks away from a possible default, should you buy or sell US stocks? appeared first on Invezz.