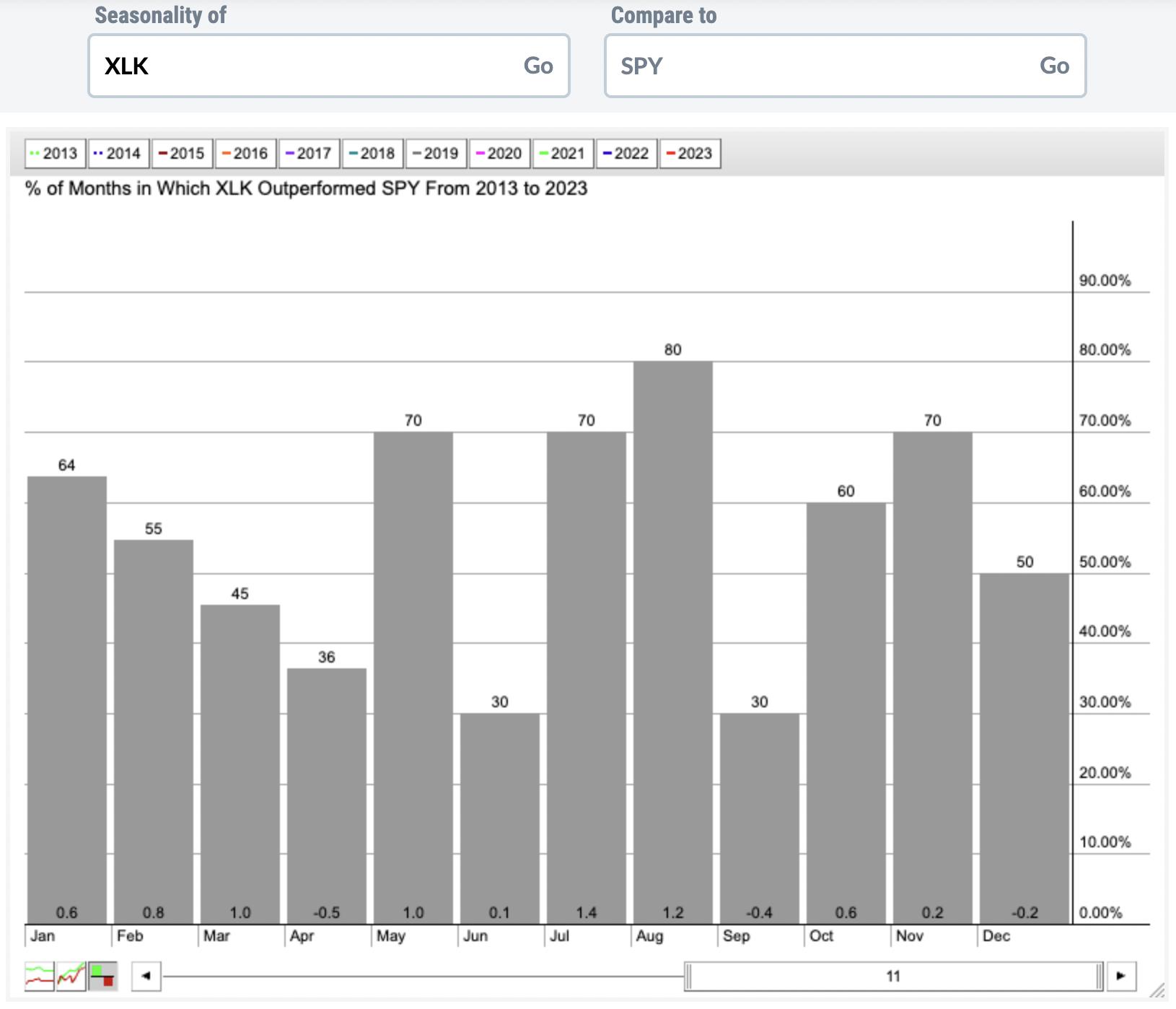

Growth-oriented stocks tend to have their best relative showing vs. value-oriented stocks beginning in May and running through August. Check out the relative seasonal performance of the XLK (vs. the SPY) over the next four months:

If you add the bottom numbers of each calendar month (represents average monthly outperformance of XLK vs. SPY since 2013), it totals 5.8%. That means that the XLK has averaged outperforming the SPY by 5.8% per year since this secular bull market began in 2013. If you add up just the four months from May through August, you’ll find that it totals 3.7%. That means that 60% of the XLK’s relative outperformance occurs during just 33% of the year (May through August). Technical indications suggest the market is going to head higher, led by technology. Seasonality supports this notion.

I’ll be providing solid trade setups throughout the May-August period in our FREE EB Digest newsletter. If you’d like to subscribe, simply enter your name and email address HERE. I’m planning to share a current favorite setup in tomorrow morning’s EB Digest.

Happy trading!

Tom Bowley, Chief Market Strategist, EarningsBeats.com